Penny stocks are popular companies among many retail traders. A penny stock is defined as a company whose stock is trading at less than $5. In most cases, these are usually tiny companies that have a small market cap.

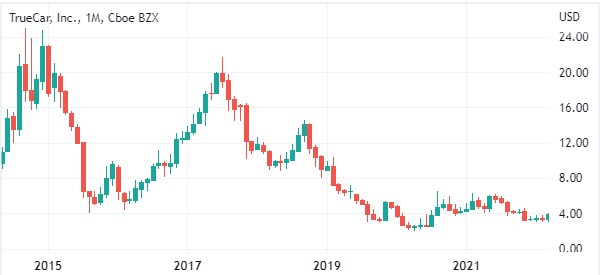

In other periods, a penny stock can be a company that was once big that has fallen out of favor with investors. A good example of this is TrueCar, which was once a beloved company. As shown below, a stock that was once trading at $25 is now trading at $3.

Some large companies that have no major issues can also become penny stocks depending on where they went public at. In this article, we will explain what penny stocks are, how they work, how to trade them, and risks involved.

Table of Contents

Welcome to the world of penny stocks!

Penny stocks trading is related to small companies that raise their funds mostly in the OTC market. The companies are mostly valued at less than $10 million (but many of these companies have a market capitalization of less than $1 million).

For such companies, it is very difficult for them to list their shares in the large bourses such as the NASDAQ. These companies are price at less than $5 a share. You will be surprised to find companies with shares trading at $0.003.

Some of these companies were once large corporations that lost their way, while others were penny stocks from the start.

Why traders love penny stocks

Most traders love penny stocks because of the price of their stocks. Since these companies trade at less than $5 per share, traders believe that they can make a fortune by spending at times less than $100.

Indeed, the benefit of trading in penny stocks is that you can make a lot of money on small movements. For instance, if you have $1000 and spot a company trading at $0.5 a share. This means that you can buy 2000 shares.

When the share price moves from $0.5 to $0.9, you will have almost doubled your money. The downside is that you can lose a lot of money if the opposite happens. With leverage, the gains/losses will be much larger, so we advise you not to abuse it.

OTC penny stocks vs NYSE penny stocks

A common question is on the difference between an OTC penny stock and a NYSE penny stock. The difference is that the former are usually listed by a company known as OTC Markets while the latter are listed in the big board at the NYSE.

Unlike the NYSE, OTC does not have very strict listing procedure because it mostly targets small companies. Instead, these stocks trade in the over-the-counter market. In most cases, these stocks are usually high-risk since they don’t provide enough details to investors.

The NYSE, on the other hand, is the most prestigious exchange globally. As such, it has a strict listing process, including a $295k listing fee. Companies are also required to pay a hefty annual fee and adhere to strict criteria to remain in the board. The same is true with Nasdaq.

We have clarified what penny stocks are. Now let’s go over how to analyze them and how we can use these shares to generate profits.

Why you should not invest, but only trade

If you are interested in penny stocks, your dream should not be to invest in the company. The dream should be to trade, where you enter and exit a trade after a short period of time.

Investing in penny stocks, where you buy and hold the stock is often a bad idea. This is because the future of these companies is often bleak.

For example, many investors buy small penny stocks of pharmaceutical companies which have a drug in the pipeline. They buy hoping the company’s drug will pass regulatory scrutiny and then become a money maker. Often, these companies fail because of the complexity of the drug creation process.

Risks involved in trading penny stocks

There are many risks involved in penny stocks. These risks are more pronounced in penny stocks that are traded in the OTC markets. Some of them include:

- Pump and dump – This is a situation where a few people boost a stock and then sell the shares when the stock rises.

- Insider trading – Penny stocks are rife with insider trading allegations. It happens when many insiders boost a stock and then exit when it rises.

- Inadequate information – Large public companies are required to file disclosures with the SEC. This information can make you make better decisions. Many penny stocks don’t.

- Unsound books – Many penny stocks lack good books. As such, information about their income statements, balance sheet, and cash flows are hard to trust.

- Liquidity – At times, many penny stocks tend to be highly illiquid, meaning that it is hard to buy or exit.

- Trading is difficult – Trading OTC stocks is a bit difficult because they are not offered by popular brokers.

How to find good penny stocks

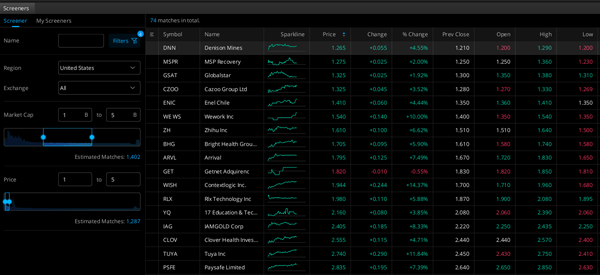

We recommend that you trade good penny stocks that are listed in popular boards like NYSE and Nasdaq. The best way to find active penny stocks to trade in is to use a screener. A screener is a free tool that lets you isolate companies on different criteria like valuations, stock prices, company sizes, and performance.

For example, the screener below shows companies whose shares are trading between $1 and $5 and those whose market cap is between $1 billion and $5 billion.

You can also look at the pre-market movers to see those penny stocks that are the most active. Most importantly, using a watchlist can help you find good penny stocks.

What to consider when trading penny stocks

#1 – Short Term

In the financial market, you can decide to trade for the long term like Warren Buffet who holds companies for decades. This is not a bad strategy especially when the companies you are dealing with are big ones such as Google.

You can also trade shares on an intraday basis.

For penny stocks, it is not advisable to trade for the long term. This is mainly because the regulation in this kind of shares.

In the listed companies in the NASDAQ, the regulations are usually a bit tough. For instance, companies must disclose a lot of information to the shareholders. In penny stocks, this is not done. Therefore, you should spot an opportunity, enter a trade, and then exit as soon as you make some money.

» Related: 1 Minute Scalping Strategy

#2 – Stop Loss

A story is told of a trader who opened a trade before going to a meeting. He sold short a pharmaceutical company called Kalobios. The trader shorted the company and then went to a meeting. A few minutes later when he came to his trading terminal, he was negative $106,000. Previously, his account had $37,000.

He forgot an important aspect in trading: the role of a stop loss.

A stop loss is a tool that gives you a chance to stop the losses at a certain level that you have determined.

As a penny stock trader, you should always ensure you have a stop loss. This will help you protect huge losses.

You can also implement other risk management strategies to protect your portfolio.

#3 – Trade Moderately

In penny stocks trading, you should always trade for a few times per day. If possible, you should trade just once. This is a concept We have promoted for quite some time in all forms of trading. The more you trade, the higher the risk you expose yourself to.

Even when you are having a winning streak, you should slow down, take your profits and then trade again the following day.

We give you this advice because analyzing some of these companies in detail will take your time. In the same way, you will have to identify the best time to start/end the trade.

Repeating this process many times or a few hours may cause you to lose clear thinking and fall into some mistakes. In short, avoid overtrading.

#4 – Companies You Understand

There are many high quality companies in the penny stocks trading world. These are companies with quality product and services and low debt.

As a penny stock trader, you should try and identify these undervalued companies and trade them. The benefit of this is that it helps you limit your exposure to toxic companies that are high volatile.

This is not always an easy task. Often the traditional fundamental analysis does not work because of the opaque nature of the penny stock companies. It is very difficult to research a company that does not make investor presentations and one that does not release its audited financials.

Therefore, the best thing to do is to use technical analysis to find the best time to enter and exit a trade: identify the trend, get in and get out when there is a reversal.

#5 Risk management

Trading the penny stock market is risky. In a day, a penny stock can move up by more than 500%. This is good if you are long the company.

The opposite is also true. In many cases, some companies have lost more than 500%. In a large cap company, this has never happened.

Therefore, it is important for you to carefully assess your risk and allocate capital accordingly. You don’t want to be caught in a situation where your account loses more money than you have within minutes.

External useful resources about Penny Stocks Trading

- What to Know About Investing in Penny Stocks – Money USNews