Pairs trading is a relatively popular trading strategy among advanced traders. It is a strategy that uses the concept of correlation to reduce risks and maximize returns. The concept is applicable to different types of assets, so it can work just as well in stocks as in currencies.

In this article, we will look at what pairs trading is, how to use it, and some of the key strategies to use.

Table of Contents

The background to understand pairs trading

Experienced traders know that currency pairs have a close relationship with each other. For example, in most cases, when the EUR/USD falls, the GBP/USD or AUD/USD will also fall as well.

The reason behind this is relatively straightforward to understand. When the three pairs fall, it means that the US dollar is strengthening. When the dollar gains, it is usually for a specific reason. As such, that spread is often spread across other currency pairs.

Therefore, in such a situation, when you have sold the EUR/USD and GBP/USD, you can expect to make a profit on the two pairs. However, if the two pairs rise, you can expect to make a loss on the two pairs.

The concept of correlation

This concept is known as correlation. It is a concept that is popular across asset classes like stocks, exchange-traded funds (ETFs), and commodities. For example, in most cases, when the DAX index rises, it increases the possibility that the FTSE 100 or the CAC 40 indices will rise as well. Similarly, unless there are major events, when Chevron shares rise, there is a possibility that ExxonMobil will also rise.

At the same time, some financial assets are known for their inverse correlation. This happens when two financial assets moves in different directions. In this case, when a financial asset rises, the other asset will have an inverse relationship.

In theory, when oil prices rise, you would expect that shares of airline stocks will decline because oil is the most expensive part of running an airline.

How pairs trading works

The concept of pairs trading works simply because it is possible to make money when a currency pair is rising or falling. When it is rising, you simply buy the pair and hope that its price will continue moving in that trend. On the other hand, when it is declining, you sell it and benefit when the price is falling.

Shorting a pair is different from when you short a stock. When you short the EUR/USD pair, you have basically bought the US dollar and sold the euro.

The first step in pairs trading should be identifying currency pairs that have a close correlation or those that don’t have this correlation. There are several steps to do this. However, the simplest one is to use your eyes and see whether the pairs are moving in the same direction or not.

Correlation coefficent

A more analytical method involves calculating the correlation coefficient between two assets. The easiest method to do this is to use Microsoft Excel or Google Sheets. To do this, you should download the data of the two currency pairs you are analyzing. After this, you should add it in Excel and then run the correlation formula.

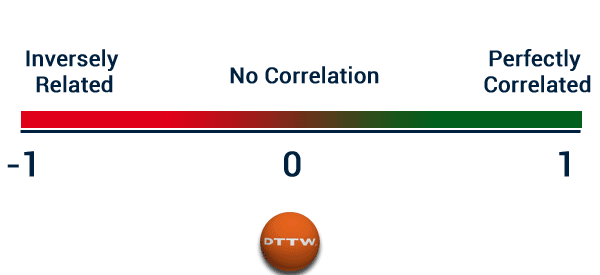

The result will be in the range between -1 and +1. When the answer is close to 1, it means that the two pairs have a close correlation. On the other hand, when the result is close to -1, it means that the two currency pairs are inversely correlated. In other words, the two pairs tend to move inversely to each other.

Finally, if the result is close to zero, it means that the two don’t have any relationship. As such, it is almost impossible to pairs trade when the result is zero.

Useful tools

Finally, the other simple way of identifying correlated or uncorrelated assets is to use the freely-available resources. Websites like Oanda and Investing.com provide a tool that shows the correlation of key currency pairs. The chart below shows the correlation between the EUR/USD and other key currencies.

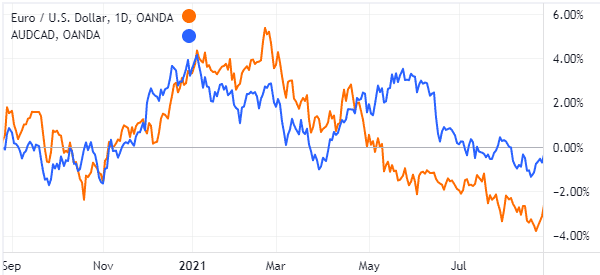

As you can see, in the past 12 months, the EUR/USD has a correlation coefficient of 0.87 against the AUD/CAD. This means that the two pairs have moved in the same direction in thar period. However, recently, the correlation has almost evaporated.

The chart below shows how close the two pairs have been in the past 12 months.

How to use the pairs trading strategy

After finding the correlation between two currency pairs, the next key step is on how to trade it.

Ideally, when you place a similar trade between two closely correlated pairs, it means that you will make money when the two move in the predicted direction. On the other hand, if the price moves in the opposite direction, you will make a bigger loss.

» Related: Start Trading Again After a Big Loss

Hedging

Therefore, the best approach when using a pairs trading strategy is to hedge. In a perfectly or closely-correlated currency pairs, you can place opposite trades.

In the example above, you could place a buy trade on the EUR/USD and then short the AUD/CAD pair. In this case, if the EUR/USD pair rises you will make money. You will lose some money on the AUD/CAD pair. Therefore, in this case, your profit will be the spread between the two.

On the other hand, for two inversely correlated currency pairs, you could place trades in the same direction. Similarly, your profit will be the spread between the two.

Summary

Therefore, while pairs trading is a good strategy, the biggest con is when the trade goes in the other direction. For example, if two currency pairs have a close correlation and you place the two trades, the correlation could change.

Besides, correlation uses historical data and is not always an indication of what will happen in the future.

External useful resources

- Pairs Trading: An Advanced Strategy for Hedging – CMC Markets