Breadth indicators are relatively different from other popular technical indicators like the moving averages, relative strength index, and MACD. For one, they are more effective in analysing equities and indices rather than other popular assets like commodities.

Another reason is that they do not necessarily have a lot of usefulness for day traders. Instead, they are mostly useful for swing and long-term traders.

In this report, we will look at the Mcclellan Oscillator, which is a popular breadth indicator.

Table of Contents

What is the Mcclellan Oscillator?

The Mcclellan Oscillator was developed by Sherman and Marian McClearm, a husband-and-wife couple who are well-known in the technical analysis industry. Like most breadth indicators, the Mcclellan Oscillator identifies the net advances and the number of declining equities of shares listed in the New York Stock Exchange and the Nasdaq.

The indicator can also be used in all other exchanges like the London Stock Exchange (LSE) and the Deutsche Boerse.

The Mcclellan Oscillator is relatively similar to other breadth indicators like the advance and decline ratio and the arms index. The only difference is that it also includes other calculations like using the exponential moving averages.

Like most breadth oscillators, the Mcclellan Oscillator (MO) can tell you whether the rally in equities is spread across all sectors. As such, using this information can help you predict whether the rally in stocks will continue or not.

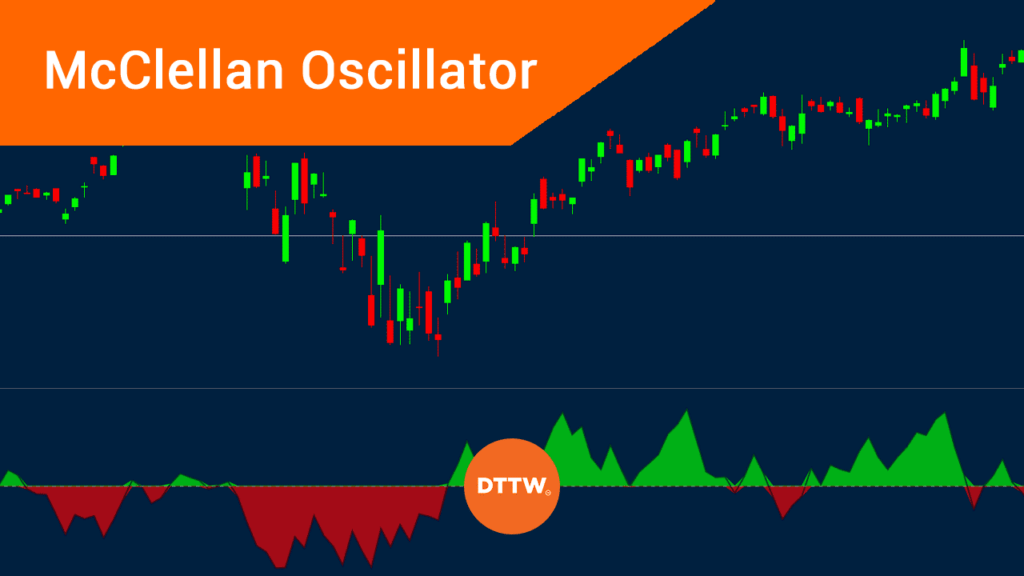

The chart below shows the MO applied in the S&P 500 chart.

What does the McClellan Oscillator tell traders

The McClellan Oscillator, like other breadth indicators, give investors a clear picture of what is happening in the market.

It acts as the MACD of the AD Line in the stock market since it sort of puts the momentum on the AD Line. The indicator favors buyers when it rises and vice versa.

Related » How to Use Market Breadth to Refine Index Analysis

How the Mcclellan Oscillator is calculated

The first step of calculating the Mcclellan Oscillator is to find the ratio-adjusted net advances (RANA). To do this, you first subtract the declines from the advances. The declines are the number of stocks that are falling while advances are the rising ones.

You then add the declines and the advances and find the answer. Finally, you divide the first answer and the second one.

The next step of calculating the Mcclellan Oscillator is to subtract the 39-day exponential moving average of RANA from the 19-day EMA of RANA.

You use the following formula to calculate the 19-day EMA:

| (Current Day RANA – Prior Day EMA) X 0.10 + Prior Day EMA.) |

Similarly, you use the following formula to find the 39-day EMA:

| (Current day RANA – Prior Day EMA) X 0.05 + Prior Day EMA) |

As you can see, the MO uses two exponential moving averages: 10% smoothing constant and 5% smoothing constant. These two MAs are based on the concepts championed by P.N Haurlan and are known as the 10% and 5% trend for brevity.

As with all technical indicators, you should never worry about the calculations since they are provided by most brokers. Instead, you should focus on adding the indicators in the chart and interpreting it.

How to interpret the Mcclellan Oscillator

There are two main conclusions derived when you look at the Mcclellan Oscillator.

Coming or Leaving Money in the market?

First, when the MO is positive or in the green, it is a sign that there is more money coming in the market. This is usually a bullish sign.

Similarly, when the Mcclellan Oscillator is negative, it means that more money is leaving the market, which is usually a bearish factor.

Identify overbought and oversold locations

Second, the MO indicator is an oscillator, which means that people look at it with a view of identifying overbought and oversold locations. When an asset is overbought, in most cases, it is usually a bearish sign. Similarly, when it is oversold, it is usually a sign that an asset is ripe to be bought.

In addition, when you add the daily values of the MO indicator, you come up with the McClellan Summation Index, which is also popular in the financial market.

How to use the MO

Colour and direction

Using the Mcclellan Oscillator is relatively easy. The most popular approach is to look at the colour of the indicator and its direction.

If the indicator is red and extremely low, it means that the market is getting oversold, which is a signal to buy. However, you should only buy when the indicator starts to rise.

The uptrend will receive more confirmation when the MO turns green and continues to rise. A good example of this is shown in the S&P 500 chart at the beginning of this post.

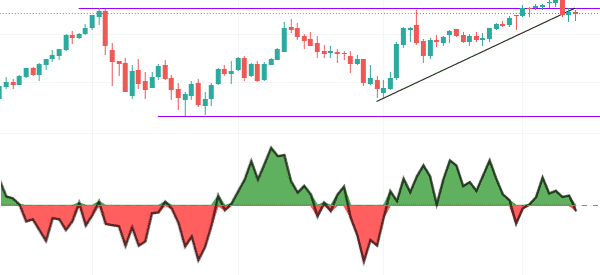

The opposite is true when considering the selling signals. Ideally, a sell signal emerges when the Mcclellan Oscillator is in the overbought territory, as shown in the Nasdaq 100 chart below. Also, you should short when it is red and dropping.

Combine with other indicators

Another way of using the MO indicator is to combine it with other indicators. For example, you can combine it with oscillators like the Relative Strength Index (RSI) and the MACD. You can also combine it with trend indicators like the moving average, average directional index (ADX), and the Parabolic SAR, among others.

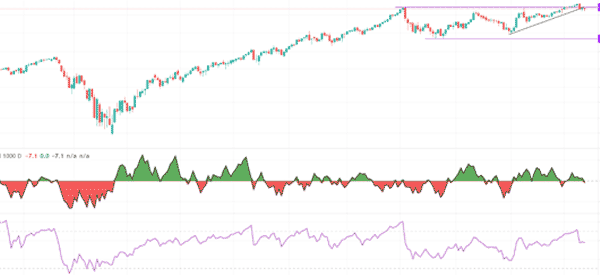

The chart below shows the Nasdaq 100 indicator paired with the MO and the RSI indicator. As you can see, a buying signal emerged when the RSI moved to the oversold level.

McClellan Oscillator and the S&P 500

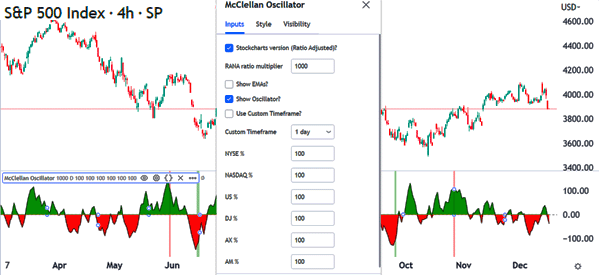

The McClellan Oscillator is usually created by looking collectively at key stock indices like the S&P 500, Nasdaq 100, and the Dow Jones. Therefore, when you apply the indicator on the Nasdaq 100 index, it will automatically compute the values based on the performance of the index.

The same applies to the S&P 500, an index that looks at the 500 biggest companies in the United States like Apple and Microsoft. In its calculation, the indicator looks at the advancing stocks in the S&P 500 index and the declining ones.

Therefore, when applying it on the S&P 500 index, it is important to select the index you want it to track.

Limitations

There are several limitations of the McClellan Oscillator. First, as a breadth indicator, it is only applicable in the stock market. It is not recommended to use it in other assets like currencies and commodities.

Second, the indicator is not very useful for day traders. In most cases, only long-term investors and swing traders find it useful. Finally, it does not provide trading signals in a simple to understand way.

Final thoughts

The McClellan Oscillator is an important breadth indicator that smoothens other breadth indicators like the advance-decline ratio. However, the biggest challenge with it is that it is not ideal for day traders and scalpers because the signals are not instant.

However, if you are a long-term day traders, using the indicator can help you identify long-term signals.

And you? Have you ever used this oscillator or do you have experiences to tell us about it? Let us know in the comments!

External useful Resources

- Other info about MO in StockCharts