Money is a tool that helps you achieve your goals. It provides your family with enough comfort and stability, making it easier to plan for the future and allowing you to save enough money for achieving new milestones you have never reached before. However, it’s important to know how to make your money work for you.

Investing can either be short term or long term. Depending on where you invest in, you can benefit from both forms of investment, but the whole idea is to know where and what you are investing in.

Let’s not wait any further because in this article we will talk more about how you can make money work for you and we’ll dive deeper into the basic levels of investing.

Table of Contents

7 Ways to make money work for you

Invest in your favorite asset

Year by year, inflation is increasing by 4% and any investments you make should be at least that much. Otherwise, you should know that your money won’t be worth as much as it was before.

For example, if the interest level of your money is only 1% or less, you’ll be losing money over time because of inflation.

When it comes to investing, there are plenty of assets you can turn to. Each individual or business will invest in areas they see as fitter. Each investment will either be good for the short or long-term and some, not good for any. The most common investments are the following:

- Stocks

- Forex

- Futures

- Crypto

Stocks

Stocks represent a share in the ownership of a company. You can buy stocks from popular companies like Apple, Tesla, Samsung, and more. Each company has a different price in stocks and over time, this might either increase or decrease.

For example, Apple’s stock price in 2007 (when they introduced the iPhone) was only $6.02, but now, it exceeds $153. If you invested $1,000 in 2007, you would now have more than $25,000.

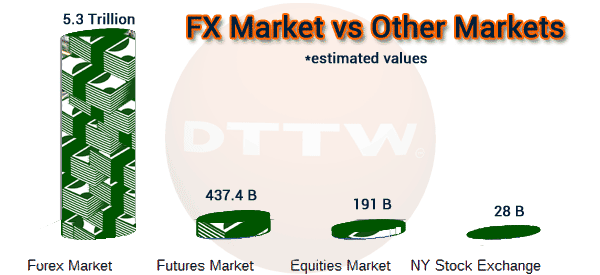

Forex

Forex is the process of making a profit through trading in currency prices. In other words, it’s short for foreign exchange and is usually conducted for several purposes, which include:

- Tourism

- Commercial purposes

- International trades

Forex is conducted on a 24-hour basis and works five days a week. The reason it is mostly performed five days a week is that it’s used by banks, businesses, retailers and more. All of these will usually work with a five-day working schedule.

Futures

Futures are a type of derivative contract agreement for buying and selling assets or security at a later date with a fixed price. In order for futures contracts to work, you need to have a brokerage account that is approved for trading them.

When investing in futures, usually involves hedging and speculating.

- Hedging: All future contracts that are sold and purchased to deliver or receive the underlying commodity are usually used for hedging purposes by a business or investor. This is usually done for managing risk in future prices.

- Speculating: Futures contracts will usually have high liquidity rates and can be purchased and sold until the expiration date. This is usually done for eliminating obligations to the actual commodity or profiting from the market’s direction for a commodity.

Crypto

Crypto is a new-generation investment that can either benefit or harm you, meaning that it’ll either be a good or bad long and short term investment. There are many cryptocurrencies available on the market, but all of them have their own market value, circulation supply and max supply rate.

For example, if you buy Ethereum, right now, its value is around $1,700, but may change each day. Ethereum is the 2nd highest-ranked cryptocurrency and can be considered a good long-term investment, but the high volatility rates still make it questionable at times.

Related » Crypto vs Stocks

Make sure to have a high-yield savings account

You are missing out a lot if you are keeping your money in a traditional savings account because of the high opportunities you have for earning interest.

A high-yield savings account functions the same way as a savings account but has a higher annual percentage yield. However, keep in mind that you need to pay taxes for this interest, but you’ll still earn more money than in a regular account.

Additionally, the amount of withdrawals you can make is much lower compared to a traditional savings account, so this means you’re much less likely to spend the money.

Get rid of all your debt

Being in debt only makes things harder for you and it’ll make you pay more than the original purchases you make. Moreover, you have to make interest payments that can significantly reduce your income.

Debt doesn’t mean money is working for you but against you! It’s all about the interest you are paying and creates a financial burden that can limit the number of choices you make.

Logically thinking about it, paying off your debt will allow you to make more money and redirect it towards more important expenses.

If you start a business, you can invest in it and it allows you to grow your wealth, creating more independence and financial stability.

If you want some ideas to pay off your debt, you can consider the following:

- Use your extra money (if you have some) to pay off your debt

- Tackle your largest debt amounts

- Pay the minimum payment on your debts, except your smaller ones

If you have much smaller debts, you can try paying them off quicker, so you can tackle the larger ones. This momentum keeps you going and allows you to get out of debt more quickly.

Create emergency funds

Surprises are scary when you don’t have any control over your finances. Unexpected car repairs, a job loss, or anything more can sometimes spiral out of control and wipe out the progress you’ve made.

Creating emergency funds is an alternative way for making money since you have already planned for surprises. If any emergency does come up, you can put the money in your fund to regain control of the situation.

Building up your emergency funds can take some time and to have an effective strategy for saving funds, it’s best to save them for at least three to six months. After you are done saving enough money and are out of debt, you can make larger contributions for growing your emergency funds faster.

Use credit card rewards to your advantage

Making money work for you includes taking advantage of your credit card rewards. Credit card rewards can offer up to 5% back on all your spending.

Taking time to see what your credit cards have to offer is an excellent way of helping you make better choices.

Include passive income

Passive income streams are an excellent way for growing your money day by day at a small amount. There are so many different methods for generating passive income. Some of them are:

- Selling a creation you made

- Sell a book or guideline you created

- Start a blog

- Invest in the stock market

- Invest in real estate

Many people may not pay enough attention to real estate, but it’s an effective way to generate passive income.

Nevertheless, you can consider rental real estate as a way for earning monthly rental income. This can help you in reducing your mortgage balance and have some extra leftover income each month. We know it’s not easy to become a landlord, but it’s never a bad idea.

Related » Housing Data Releases: Why They Are Important

Don’t forget to choose an account provider

After you clarify what kind of account you want, you need to choose an account provider. You can do this in two ways:

- Having an online broker: Allows you to self-manage your account, buy and sell investments, include stocks and bonds, and more. An online brokerage account is an excellent option for investors who want more investment options and care about account management.

- Robo-advisor: In a portfolio management company, the PC will do most of the work for you, building and managing portfolios based on your risk tolerance and investment goals. However, keep in mind that for a robo-advisor, you’ll be paying an annual management fee of 0.25% to 0.5%. If you’re considering investing in bonds or individual stocks, robo-advisors might not be the ideal solution because they use funds.

If you’re just getting started, there’s no need to get worried. You can always start out with an initial deposit and the best part is that you can conduct automatic transfers from your paycheck or investment account in case your employer allows it.

The final cutdown

Money is not as complicated as it seems, but many people can’t understand its techniques and how to make it work for them. Once you start to get something going, you should seek to continue that flow.

Once you get this flow going, you’ll be able to easily make money work for you. After that, everything will only start to become easier, so put all of these tips into practice as much as you can.