Going long and short are two popular and concepts in the financial market. If you have spent some time following the financial market, you have likely heard of traders who are long or short certain assets. You have also possibly heard about the so-called long-short hedge funds.

This article will look at the difference between going long and short an asset and how to do it well.

Table of Contents

What is going long?

Going long is the simple concept of buying a financial asset and hoping that its price will rise. You can go long all financial assets like stocks, exchange-traded funds (ETFs), and commodities.

For example, if a stock is trading at $10, you can buy it if you expect that its price will keep rising. In this case, you will be in the money if it rises above $10. Similarly, you can go long the EUR/USD pair at 1.1200 and exit when it rises to 1.1220.

What is going short?

Going short is the opposite of being long a certain asset. When you go short, you are basically hoping that its price will decline. For example, if a stock is trading at $20, you will make a profit when it declines. The concept of shorting is relatively complex than being long.

The first step of shorting an asset is to borrow shares from someone. In most cases, you will borrow the stock from the broker and then sell it in the open market. After selling it, you will be left with cash. Therefore, when the stock drops, you will then buy it back and return the shares to the broker.

For example, assume that the stock is trading at $10 and you expect it to drop to $5. And you have a $10,000 account. In this case, you can go to the market and borrow 1,000 shares and then sell them. If your trade goes right and the shares go down to $5, you will then buy them back. In this case, you will buy 1,000 shares at $5, meaning that you will have made a $5,000 profit.

In reality, because of technology, when you short a stock, you will not need to borrow these shares. All you need to do is to select the number of shares you want to short and implement the transaction right away.

Related » All the short selling strategies you should know

Strategies to go long and short a stock

The process of going long and short a stock and other financial assets is a relatively easy one. All you need to do is to do three things (which are the basics of everything in trading), including:

- Fundamental analysis – This is where you look at broad issues like news, economic data, and deep corporate issues like profitability, valuation, and revenue growth. For example, if you identify a stock that is undervalued and one that has catalysts, you can buy the shares.

- Technical analysis – This is the process where you use technical tools like moving averages and the Relative Strength Index (RSI) to forecast where the shares will go to.

- Price action – This is the analytical process where you look at chart patterns and determine where the price will move to next. Some of the top patterns to look at are triangles, head and shoulders, and cup and handle patterns.

Risks of going long and short

Trading is a risky businesss and all types of trades are relatively risky. For example, you can buy a stock at $10 only to see it falling back to $5. In this case, you will have lost more than 50% of your funds. This is a common thing that happens to traders every day.

When you are long a stock, the maximum loss that you can make is your wager amount. For example, if you bought shares worth $10,000, the worst thing that can happen is for the stock to drop to $0.

Short selling is riskier than being long a stock because there is no limit on how high a stock can go. As such, it is often said that the maximum loss that you can make when short selling is infinite. When a stock you are short makes a parabolic rally, the situation is known as a short squeeze.

Short squeeze examples

Historically, there have been many short squeezes. For example, for years, many value investors talked about how overvalued Tesla was because of its massive losses. As such, many of them like Jim Chanos went on and shorted the stock. During the pandemic, the stock soared so high, pushing the company to become the most valuable automaker in the world.

Related » How to Identify Short Covering!

This price action led to losses worth billions of dollars to short sellers.

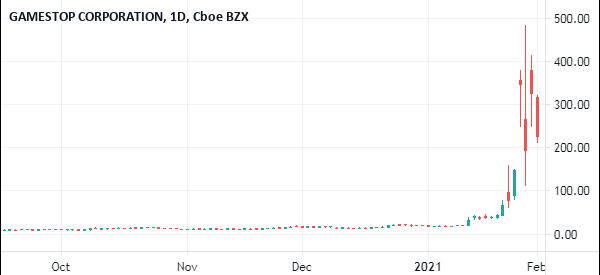

In 2021, Wall Street Bets became a thing as retail investors started to focus on highly shorted companies like GameStop, AMC, and Clover Health. These companies (known as meme stock) had a relatively big short interest. As such, short-sellers lost billions of dollars as their shares jumped.

Risk management

Finally, since trading is a risky business whether you are long or short, it is important that you do risk management to minimize the amount of risks that you are exposed to. Some of the top risk management strategies you can use when trading are:

- Having a stop-loss – A stop-loss is an important tool that will automatically stop your trade when a certain loss level is reached.

- Position sizing – You should size your trades well. In this, you should ensure that you open small trades that will not expose your account to a lot of risk.

- Short-Long ratio – Because shorting is riskier than being long, ensure that you only short a small part of your portfolio.

Summary

In this article, we have looked at two ways of implementing trades and some of the risks involved. We have also looked at some of the top risks of going short a financial asset and why the short portfolio should form a small portion of your total account.

External Useful Resources

- Long Stocks vs Short Positions and Which Strategy Is Better? – Bullish Bears