Short squeezes have become incredibly popular in the past few years as the role of social media platforms like StockTwits and Reddit.

It became more popular due to the popularity of Wall Street Bets, the popular Reddit channel (and meme stocks like GameStop). In this article, we will look at what short covering is and how to identify it when trading.

Table of Contents

What is a short trade?

There are two main types of trades in the market. First, you can decide to go long an asset, where you buy and wait for the price to rise. This is the most popular method of making money in the market.

Second, you can execute a short trade, where you place a bet that an asset’s price will start and continue falling.

The technicals behind short-selling is a bit complicated since it involves borrowing shares, selling them for cash, and then buying them when the price drops.

Using modern trading platforms, you can easily place a short trade by just clicking a button.

What is a short squeeze?

To understand what short covering is, it is also important to focus on what a short squeeze is. When you open a long trade, the maximum loss you can make is the amount of money you invested in.

For example, if a stock is trading at $10 and you buy $100 shares at $10,000, the maximum loss you can make is if the stock falls to $0.

For a short trade, the situation is significantly different. Since you borrowed money and since a stock has no limit to how high it can go, it means that the maximum loss you can make is infinite.

Related » How To Identify & Navigate A Squeeze!

For example, as shown below, the price of GameStop stock surged from about $5.30 in January 2021 to $120 in the same month. This is known as a short-squeeze since short-sellers saw substantial losses.

What is short covering?

Now that you know what short-selling and a short-squeeze are, understanding what a short covering is a bit easy.

Short covering is a situation where a short-seller who is facing a loss or a short-squeeze starts buying back securities to reduce losses and exit the trade. Short covering involves buying back the stock and returning it to the lender.

Related » Other good ways to short a stock

How short covering works

Short covering is the simple process of buying back a stock that you have placed a short trade on. There are three main reasons why this can happen.

First, short covering can happen because your trade has become profitable. In this case, you will buy the stock with the goal of returning it to the original holder.

Second, you can start short covering when you change your mind about the original thesis. You can do this whether the trade is profitable or when it is not. Finally, you can do short covering when your trade is deep in the red.

For example, assume that a stock is trading at $50 and you place a short trade. In this case, if the stock drops to $45, it means that you are profitable. As a result, you can decide to cover the short sale.

Related » Short Selling in a Bear Market

How to identify short covering

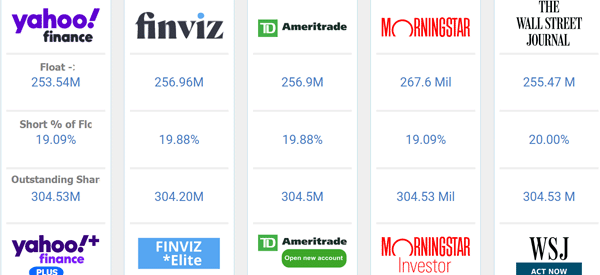

It is always difficult to identify short covering in the financial market. One way of doing this is to look at data compiled by some of the most popular websites in the market like Yahoo Finance, Finviz, and Morningstar.

Instead of looking at them individually, you can look at them using one of the popular compilation software, such as FloatChecker. For example, the chart below shows the short interest of GameStop.

For starters, short interest refers to the percentage of a stock that is held by short-sellers. A higher number means that a company’s stock is under intense pressure from short-sellers. The chart below shows that about 20% of all of GameStop shares are held by short-sellers.

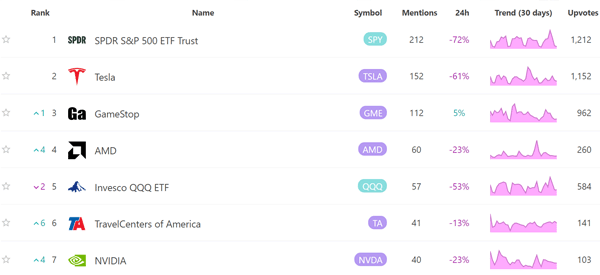

Another website that you can use is ApeWisdom, which compiles the mentions and activity of different stocks and ETFs in social media platforms like StockTwits and Reddit. The chart below shows some of these stocks and their trends.

Look for the headline catalyst

There is no trading strategy to use in times when there is short covering in the market. One of the best things to do in such a period is to identify a potential headline catalyst that will move the stock. Some of the top headlines that people look for are:

- A company’s strategic update. This is where the management looks to convince investors about the stock.

- Earnings. In most cases, short covering can happen when a company publishes strong results. This happens as short-sellers change their mind about the company.

- Acquisition – If a company you are short is being acquired, it means that short sellers will start running for the exit.

- Federal Reserve – The Fed is an important entity in the market since it influences interest rates. As such, a change in mind by the bank can lead to more short covering.

Summary

In this article, we have looked at what short-selling is and how it works. We have also assessed how short-covering works and how to trade it well. Most importantly, we have looked at the key risks of short-selling and how to identify headline catalysts.

External useful resources

- What Is the Difference Between a Short Squeeze and Short Covering? – Investopedia