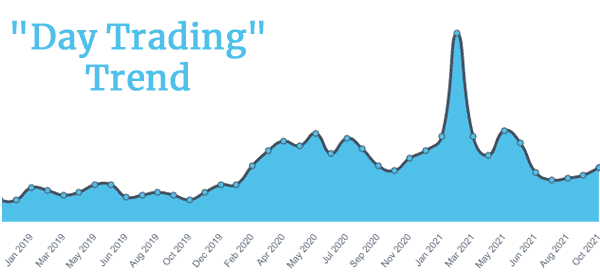

Day trading is increasingly becoming popular among many people in most countries. Indeed, this trading saw explosive growth during the Covid-19 pandemic.

Still, a common question many people ask is on the amount of money you need to start day trading. In this article, we will explore this topic and explore some of the things to think about.

» Related: FULL GUIDE: How to start day trading

Table of Contents

Minimum amount to day trade

Ideally, many brokers have reduced the limits on the amount of money that you need to have in an account.

For example, in the United States, companies like Robinhood and Schwab don’t have a minimum deposit for their most basic accounts. This means that you can start investing with as little as $10. Most of these brokers also have a minimum balance for some of their margin accounts.

The same applies to other forms of accounts. For example, most cryptocurrency exchanges like Gemini and Robinhood don’t have a minimum deposit. This has seen them attract all types of traders, including those who don’t have a lot of money.

Still, while brokers don’t have a limit on minimum deposit, this does not mean that it is a good thing to start very small accounts. Indeed, many day traders lose money partly because of their trade accounts.

Considerations on money needed to trade

Day trading is relatively risky. Indeed, in the past, we have seen many people lose money in the market. More than 80% of people who start trading often lose money. Therefore, there are several rules that we recommend when you are thinking about trading.

Start small

First, always trade with money that you can afford to lose. For example, if you are a millionaire, then it makes sense to have a trading account worth more than $100k.

On the other hand, if you are a student with about $5,000, we recommend that you start trading with a relatively small account. In other words, you should not start trading with money that you cannot afford to lose. Doing so can lead to substantial losses and financial setbacks.

» Related: Become a successful trader starting small

Your financial situation

Second, evaluate your financial situation before you start trading. For example, ask yourself whether you have cash at hand that you can use for emergencies. In other words, ask yourself whether losing your funds will lead to a major financial crisis for you and your family.

We always recommend that people should avoid trading with funds set aside for school fees and medical emergencies.

Why are you trading?

Third, consider the main reason why you are starting the trading journey. Some people start trading in a bid to supplement their regular income. Therefore, these people can have relatively small accounts if their goal is not to generate a lot of money.

On the other hand, if you are moving to become a full-time day trader, then you will need to have a relatively big trading account.

Trading with a small account

The main reason why many people ask the question about the minimum amount to trade is that they don’t have a lot of money to start trading with.

Still, depending on the amount of money you have, there are several ways of trading in the market.

Leverage

First, most brokers offer something known as leverage. This is a margin loan that you can use to implement trades with.

For example, if you have just $1,000 and a broker has a 1.30 leverage, it means that you can trade with about $30,000. The benefit of having margin is that you can make more money than when you have a cash account. The risk of using this account is that it can lead to substantial losses when a trade goes against you.

Prop firm

Another limitation of a margin account in the United States is that your broker can implement limitations depending on your trading style. For example, the broker can easily classify you as a pattern day trader (PDT) if you open more than four day trades in a week. The extreme consequence is that your account could be suspended for a while.

Another way of trading with a small account is to join a prop trading firm. These are firms that provide you with funds that you need to start trading. For more info on proprietary trading, you can read our post.

For example, at Real Trading, you can start trading with thousands of dollars by just depositing a small amount of money. Other prop trading firms allow you to trade with thousands by depositing less than $500.

Risk management

Meanwhile, you should embrace risk management strategies regardless of the amount of money that you have. Some of the risk management strategies are lowering your leverage, reducing the size of your trades, and always having a stop-loss on your trades.

Summary: don’t start too small

In this article, we have answered the question on the amount of money that you need to start trading with. We have seen that you should not start with a very small account because it exposes your account to more losses.

Also, we have looked at some of the top ways of trading with a small account.

External useful resources

- How much capital do you need to become a day trader? Quora