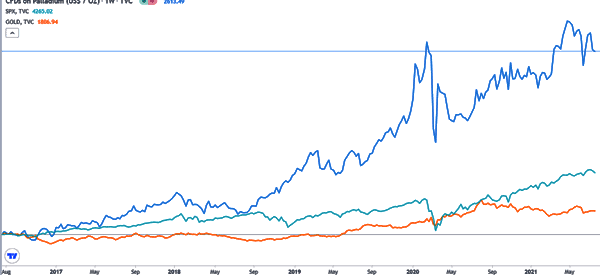

Palladium, a rare and valuable precious metal, has garnered significant attention in the financial markets due to its diverse applications and limited supply. As a result, an increasing number of traders and investors are turning to palladium as an attractive trading option. Just have a look at this chart.

It is therefore obvious that this is a commodity that has proven to be excellent for long term traders. Let’s see, however, if there are also chances for day traders to make profits.

This article explores the fundamentals of palladium trading, the key factors influencing its price, and effective day trading strategies to capitalize on its market volatility.

Table of Contents

What is Palladium?

Palladium is a precious metal found deep inside the earth’s crust. It is white in color and is found mostly in South Africa, Zimbabwe, and Russia.

It belongs to a group of metals known as Platinum Group Metals (PGMs). Other metals in this category include rhodium, platinum, ruthenium, osmium, and iridium.

In its mining, palladium is mostly a byproduct of other metals such as platinum and nickel.

What is it used for?

This metal is mostly used as a catalytic converter in the automobile industry. This is a similar use as that of platinum. The only difference is that palladium is used mostly in diesel-powered vehicles while platinum is used in petrol-powered vehicles.

As a catalytic converter, platinum is placed in the exhaust pipes to help reduce the amount of carbon released in the atmosphere. It is also used in the jewelery and dentistry.

Difference between Trading Palladium and Other Precious Metals

While trading palladium shares similarities with other precious metals like gold, silver, and platinum, there are notable differences.

Palladium’s primary industrial use in catalytic converters gives it a unique link to the automotive sector, causing it to react differently to certain economic factors.

As a result, traders must be attuned to developments in the automotive industry and global environmental regulations when day trading it.

Palladium Market Fundamentals

Understanding the underlying market fundamentals of palladium is crucial for successful trading. The primary drivers of its prices include:

- industrial demand

- automotive manufacturing

- geopolitical events

- global economic indicators

As a vital component in catalytic converters for vehicles, changes in automotive industry trends can significantly impact the palladium market.

Additionally, geopolitical tensions and economic fluctuations can influence supply and demand dynamics, affecting palladium prices.

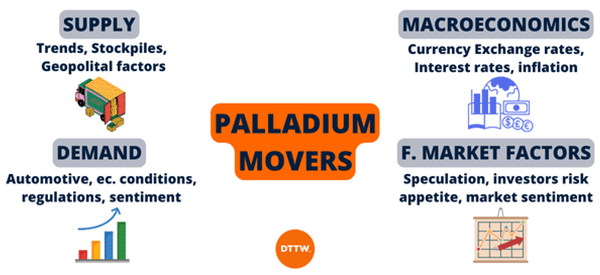

What Move Palladium Price?

Understanding what moves the metal price is crucial for traders and investors to make informed decisions and navigate the market effectively.

Several key factors influence palladium prices, and they can be broadly categorized into supply-side and demand-side drivers. Let’s delve into these factors in-depth.

Supply-Side Drivers

Palladium Production and Mining Trends: The primary source is mining, with Russia and South Africa being the leading producers. Any disruptions or changes in production from these countries can significantly impact supply levels, leading to price fluctuations.

Stockpile Levels: Palladium stockpiles, both from official reserves and recycled materials, play a role in determining market supply. Changes in inventory levels can exert pressure on prices, especially during periods of increased demand or supply shortages.

Geopolitical Factors: Political instability, trade disputes, or sanctions in major palladium-producing countries can disrupt production and supply chains, leading to price volatility.

Exploration and New Mining Projects: The discovery of new palladium deposits or the successful development of mining projects can alter future supply projections and influence investor sentiment.

Demand-Side Drivers

Automotive Industry Demand: The automotive sector is the largest consumer of palladium, primarily due to its use in catalytic converters to reduce harmful emissions. Changes in global automotive production and sales directly impact the demand.

Related » How to trade the electric car sector

Economic Conditions: Economic growth and industrial activity can drive demand for palladium in various applications, such as electronics, dentistry, and jewelry. Robust economic conditions generally lead to increased industrial demand for it.

Environmental Regulations: Stringent emission standards and regulations aimed at reducing vehicle emissions can lead to increased demand for palladium in the automotive industry.

Investor Sentiment and Speculation: Like any financial asset, palladium prices can be influenced by investor sentiment and speculative activities. Positive market sentiment or increased interest from speculators can drive prices higher, while negative sentiment can lead to price corrections.

Substitution Effect: Palladium’s scarcity and high prices can lead manufacturers to consider substituting it with other metals like platinum or rhodium, depending on their application and cost considerations. Such substitutions can impact palladium demand.

Macroeconomic Factors

Currency Exchange Rates: Palladium, like other commodities, is often priced in U.S. dollars. Therefore, changes in currency exchange rates can affect the purchasing power of international buyers and, subsequently, palladium demand and prices.

Interest Rates and Monetary Policy: Central bank policies, such as interest rate decisions and monetary stimulus measures, can influence investor behavior and impact the overall demand for precious metals.

Inflation and Deflation Concerns: Inflationary pressures or deflationary risks can drive investors to seek refuge in precious metals like palladium as a hedge against currency depreciation or economic instability.

Global Economic Performance: The overall health of the global economy can have broad implications for palladium demand, especially in industrial applications and the automotive sector.

Financial Market Factors

Market Speculation: Short-term price movements in the palladium market can be influenced by speculative trading activities and market sentiment.

Investor Risk Appetite: During times of economic uncertainty or market volatility, investors may increase their exposure to safe-haven assets like palladium, leading to upward price movements.

Commodity Market Sentiment: Changes in the sentiment of the broader commodity market can spill over to palladium, especially considering its status as an industrial and precious metal.

Trading Strategies for Palladium

To maximize trading opportunities in the palladium market, traders employ various strategies. Technical analysis involves studying historical price data and chart patterns to identify potential entry and exit points.

Fundamental analysis delves into supply-demand dynamics, industry trends, and macroeconomic factors affecting palladium prices.

Sentiment analysis gauges market sentiment and investor behavior to anticipate price movements. A balanced approach incorporating these strategies can enhance a trader’s decision-making process.

Main Ways to Trade Palladium

There are several ways to access the palladium market for day trading. Traditional individual stock trading allows traders to invest directly in palladium mining companies or companies with significant exposure to this metal.

Alternatively, Exchange-Traded Funds (ETFs) offer a diversified approach by tracking the performance of palladium. For those seeking higher leverage and direct exposure to palladium prices, futures contracts provide a viable option.

Each method comes with its risk profile and liquidity considerations, so traders should carefully evaluate their preferences and risk appetite.

Risk Management

Day trading palladium can be inherently risky due to price volatility. As such, risk management is paramount to protect capital and ensure long-term profitability.

Traders should set clear stop-loss levels, adhere to position sizing rules, and maintain a disciplined approach to avoid emotional decision-making. By managing risk effectively, traders can survive market downturns and capitalize on profitable opportunities.

Regulations and Legal Considerations

Traders must be aware of the regulatory landscape governing palladium trading in different regions.

Compliance with legal requirements ensures a trader’s activities remain within the bounds of the law, preventing potential penalties or account restrictions.

FAQs about trading palladium

Is day trading palladium suitable for beginners?

Day trading palladium involves rapid decision-making and exposure to market volatility, making it a high-risk trading style. As such, it may not be suitable for beginners with limited trading experience.

Novice traders are encouraged to gain a strong foundation in basic trading concepts, risk management, and technical analysis before venturing into day trading this precious metal. It’s advisable to start with a more conservative trading approach and gradually transition to day trading as one gains proficiency and confidence in their trading skills.

What are the main risks associated with day trading palladium?

Day trading palladium carries several risks that traders must be aware of.

1. Price Volatility – Palladium prices can experience substantial intraday swings, exposing traders to rapid gains or losses.

2. Lack of Liquidity – In certain market conditions, the trading volumes may be low, leading to wider bid-ask spreads and potential difficulty in executing trades at desired prices.

3. Leverage Risks – Trading on margin can amplify both gains and losses, magnifying the impact of market movements.

4. Market Sentiment Shifts – Unexpected news, geopolitical events, or changes in economic indicators can swiftly alter market sentiment and palladium prices.

5. Overtrading and Emotional Decisions – Rapid trading can lead to overtrading and emotional decision-making, compromising a trader’s discipline and strategy.

Can I use the same strategies for day trading palladium as I do for other assets like stocks or forex?

While some trading strategies, such as technical analysis and risk management principles, are transferable across various asset classes, it’s essential to recognize that each market has its unique characteristics.

Day trading palladium requires an understanding of the metal’s supply-demand dynamics, the automotive industry’s impact, and its sensitivity to macroeconomic factors. Traders should adapt their strategies to account for palladium-specific drivers and price behaviors.

Additionally, the level of price volatility and liquidity in the palladium market may differ from other assets, influencing the choice of trading strategies and risk management techniques.

Summary

In conclusion, day trading palladium offers an exciting and potentially profitable venture for traders. By understanding the market fundamentals, employing effective trading strategies, managing risks, and maintaining the right mindset, traders can navigate the palladium market with confidence.

However, it is essential to stay informed, adapt to changing market conditions, and adhere to regulations to ensure a successful and sustainable trading journey.

External Useful Resources

- Learn more on Commodity