Financial markets are not predictable, and traders aren’t either! In day trading, as in any other job, the human factor plays a significant role. We could say that half of your success depends solely on you whatever career you choose.

Take team sports, such as football or basketball, as an example. Your opponents are only a part of the factors at play. And even with the absolute strongest team, with the wrong approach, you will lose. The same thing can be said about motor sports, though.

In short, you are an active player with the potential to influence the outcome, both positively and negatively.

Succeeding in the financial market is not always easy since your competitors are big hedge funds and investment banks with decades of experience in the industry. To a large extent, the success rate of most day traders is usually less than 20%.

There is a mistake many people make: starting to trade in financial markets without the proper amount of knowledge. Neither technical nor personal.

Because understanding the markets, alone, is not enough to become a successful trader. We also need to understand ourselves, to avoid being our own worst enemies.

Table of Contents

The nature of trading

In day trading, participants make predictions on the next price action of an asset. They place a buy trade when they expect the financial asset to rise and then short it when they expect the price to retreat.

There are thousands of assets that a person can trade. For example, in the US, there are over 5,900 publicly traded companies listed by key exchanges like the NYSE and Nasdaq. There are over 17,000 stocks traded over the counter. Globally, the number is even bigger.

Further, there are tens of commodities that you can trade, including gold, silver, aluminum, corn, and wheat. There are also key assets like bonds, ETFs, and cryptocurrencies.

There are also numerous strategies that a trader can use in the financial market. Some of these strategies include trend-following, algorithmic trading, quant trading, news trading, scalping, and arbitrage.

Some traders are excellent in just one of these approaches while others make a fortune focusing on several of them.

The nature of the trader

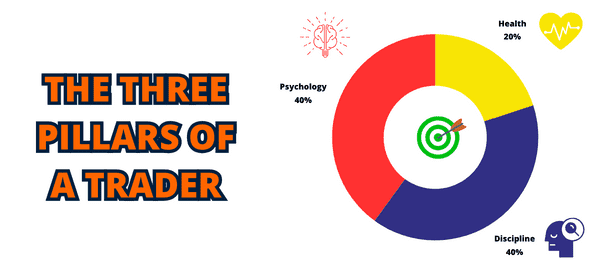

The success of a trader is not solely determined by market conditions or strategies (market volatility, access to funds, interest rates, liquidity, and market sentiment).

It’s a holistic interplay of various factors, collectively defining the nature of the trader. Understanding and mastering these elements is crucial for consistent success in the unpredictable world of financial markets.

These elements encompass both tangible and psychological aspects, shaping the trader’s ability to navigate the unpredictable financial markets.

Related » Which is your trading style?

Health Matters

Beyond the screens and charts, a trader’s physical well-being is a cornerstone of their success. Optimal health is not just a personal concern but a strategic advantage, because it directly influences a trader’s performance.

When a trader is in good health, they possess the resilience needed to weather unexpected challenges. Even in the face of ailments such as the flu, a robust trader can adapt and continue executing well-informed decisions.

The physical state of a trader is not merely a personal matter; it is an asset that can be leveraged to secure a competitive edge in the ever-changing landscape of financial markets.

Focus and Discipline

In the dynamic and often chaotic realm of trading, every day is a new battle. The ability to stay focused and disciplined amidst the constant flux of information and market movements is the unsung hero of a trader’s journey.

Consistency in approach, regardless of market conditions, becomes the bedrock for long-term success. It’s not just about making the right decisions (because, at times, you could fail); it’s about making them consistently.

The trader’s focus is the compass guiding them through market complexities, and discipline is the force ensuring they stay the course even when faced with adversity.

These qualities elevate a trader from mere participation to mastery in the volatile world of financial markets.

The Psychological Landscape

The psychological aspect of trading transcends charts and analytics. Confronting biases and managing emotions is a pivotal skill set that distinguishes successful traders from the rest.

Navigating the intricate web of one’s own mind, especially during volatile market conditions, is an art that successful traders master. It involves recognizing and mitigating cognitive biases, understanding the emotional toll of wins and losses, and maintaining a resilient mindset in the face of uncertainty.

The trader’s ability to navigate this psychological landscape is not just a complementary skill; it’s a defining trait that transforms them from a market participant to a true maestro of financial markets!

In the world of trading, where numbers meet emotions, mastering the psychological landscape is the key to sustained success.

Key to success

Your ability to generate profits hinges on the harmonious interplay of these three fundamental entities. Consider them as the pillars supporting your success in the intricate world of trading. Even if one falters, the positive sum of health, focus, and psychological resilience can still pave the way to profitability.

For instance, imagine a scenario where your health is not at its peak, perhaps due to illness. Despite this setback, a trader equipped with discipline and a sharp focus can still make informed decisions, albeit with some performance compromise.

Similarly, on days when emotions threaten to disrupt your focus, a disciplined approach can mitigate the impact, ensuring you remain on the right track.

Of course, the ideal scenario is to optimize each entity for peak performance. However, the reality of trading acknowledges that challenges may arise. What matters most is the collective strength of these entities, ensuring that even in suboptimal conditions, you remain resilient and capable of making strategic decisions.

The true challenge arises when the sum of these entities turns negative. It’s at this point that the delicate balance tips, and challenges intensify.

Recognizing and rectifying this imbalance becomes paramount. The negative sum not only jeopardizes your profitability but also places the very foundation of your trading endeavors at risk

Why you could be your worst enemy when trading

At times, as a trader, you can be your own worst enemy while moving in the financial markets. For example, when you are not healthy, there are chances that you will not be as efficient as when you are fine. Though, as we said, this alone is not a factor in determining the failure of your transactions.

If you start to lose your discipline, and your mental control, the real troubles will start to come. Your analysis will begin to worsen and bias to affect your choices.

Your emotions

One of the most important traits in the financial market is your emotions. You can be an excellent trader and end up losing money simply because you did not manage your emotions well.

Emotional issues happen in good and bad times. When you make substantial profits, you might want to continue trading without doing a lot of analysis. For example, when your buy trade rises, you might be tempted to open the same trade again. In most cases, doing this can lead to substantial losses.

They also work when you make substantial losses in the market. You can open a separate trade to recover your losses. In this situation, you can open a bigger trade to accelerate your recovery.

Other emotional issues that can impact your trading results are panic selling, revenge trading, and being extremely greedy.

Analysis paralysis

The other way that you can be your own worst enemy is known as analysis paralysis. This is a situation that is characterized by overanalyzing information, working towards perfectionism, feeling overwhelmed, and procrastination.

One of the popular approaches that this happens is when you use tens of technical indicators in the financial market. In most cases, this does not work out well. Instead, you should focus on using two or three indicators instead of so many.

Overconfidence

You can also be your own worst enemy because of being overconfident. When you are so overconfident, chances are that you will overlook key issues in your decision-making.

You can overlook doing sentimental and technical analysis before you open a trade. In most cases, this overconfidence can lead to bigger losses.

No risk management

Risk management is one of the most important things in the financial market. It refers to the process of limiting losses while maximizing returns.

Some of the top risk management strategies in the market are having a stop-loss and a take-profit, doing proper position sizing, and avoiding too much leverage.

In some cases, risk management can prevent a trader from making a lot of money. For example, take-profit and small lot sizes and leverage can limit your upside potential.

Therefore, some traders avoid using these risk management strategies and expose themselves to substantial losses.

Not following your rules

As a day trader, you must have rules. Some of these rules include not leaving your trades open overnight, using a small leverage, and trading certain assets like stocks and currencies. When you don’t follow your rules, there are signs that you will lose money in the long term.

There are other ways where you can be your own worst enemy in the financial market, including: not using a trading journal, having fear and greed in the market, or buying financial assets without doing any research.

Summary

In navigating the intricate landscape of financial markets, the essence of “The Nature of the Trader” extends beyond a mere understanding—it demands active self-assessment.

Recognizing the intricate dance between health, focus, and psychological resilience is not just a theoretical exercise; it’s a call to action. Traders must engage in continuous self-reflection, evaluating the harmony within these three pillars.

Assessing one’s health, maintaining unwavering focus, and mastering the psychological intricacies are not just components of a successful strategy; they are the very essence of trading mastery.

Aspiring and seasoned traders alike must heed this imperative—regular self-assessment is the compass that ensures they remain on the path to sustained success in the dynamic world of financial markets.

External useful resources

- 7 Questions for your trading self assessment – Top Step