A contrarian is defined as a person who goes against the masses or popular opinion. The idea behind this is relatively simple.

It is based on a famous quote by Warren Buffett. In his writings, Buffett advised investors to be greedy when other people were fearful and be fearful when others were greedy.

In this article, starting from this assumption we will look at what a contrarian trading strategy involves and when makes sense to use it.

Table of Contents

What is the contrarian trading strategy?

Fear and greed are the two main driving forces in the financial market. Fear refers to a situation where investors or traders are afraid of buying an asset. As a result, it leads to a significant sell-off in that asset.

Greed, on the other hand, is a period when investors or traders are rushing to buy an asset without looking at the fundamentals.

For example, in the past few years, we have seen the prices of many cryptocurrencies that have no utility value jump. Meme coins like Dogelon Mars and Shiba Inu are good examples.

Related » Herd Behavior of the Investors is Risky?

Therefore, in all these situations, a contrarian trader is someone who looks at the situation and decides to avoid what the mass is doing. In this, the trader will sell or short an asset that they believe is not worth it and then buy an asset they believe is being undervalued.

Wall Street Bets example

Contrarian trading or investing can be a risky exercise especially in a period of low-interest rates or when there is irrational exuberance.

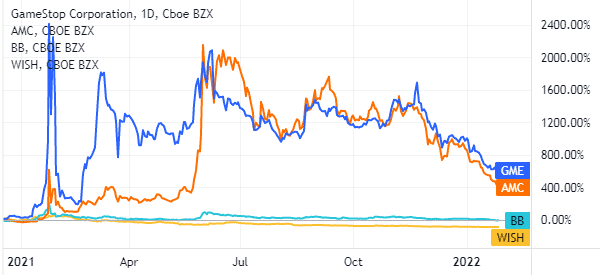

For example, investors who shorted Wall Street Bets (WSB) stocks like GameStop and AMC experienced a short-squeeze in 2021 as their shares jumped.

To a large extent, these contrarians were right in shorting these companies. Besides, most of them were troubled companies that had existential problems. However, at the time when the WSB was happening, investors were not looking at the fundamentals.

Related » The Herding Bias Explained

Still, there are many short-sellers who jumped in and placed bets against these stocks. At the time, even the most experienced market players were against betting on these stocks.

In exactly one year after the WSB happened, these contrarians have been proven right. As shown below, stocks of companies like GameStop, AMC, Blackberry, and ContextLogic (WISH) have all retreated sharply.

Tools used by contrarian traders

There are a number of tools that contrarian traders use to determine whether to buy or sell an asset in the market.

Commonsense!

First, most contrarians use their commonsense to determine whether to buy or sell an asset. For example, at the height of the Wall Street Bets situation, a company like GameStop was being valued at more than $10 billion.

That was not making sense since the company was a loss-making firm that was in a slowing industry as people shifted to game streaming.

» Related: Trading the Gaming and eSports Sectors

Valuation Metrics

Second, they use valuation metrics to determine whether a company is a good investment or not. There are several valuation metrics commonly used. For example, the discounted cash flow method uses analysis to estimate the value of the firm based on the private value of cash flow.

Other methods of valuing a firm are price-to-sales ratios, price-to-cash flow, price to earnings ratios, and comparison with peers.

Market Sentiment

Third, they use tools that gauge the market sentiment. For example, one of the best tools to use is the fear and greed index. The tool, which was designed by CNN Money identifies various market sentiment situations by looking at various gauges in the market such as the VIX index and demand for safe-haven assets.

When there is a major sell-off, the fear and greed index drops and approaches 1. In this period, a trader can decide to buy stocks because they believe that their prices will rebound. Similarly, when there is extreme greed, a trader can short stocks hoping that their prices will retreat.

Technical indicators

Finally, contrarian traders often use technical indicators to decide whether to buy or sell a financial asset. Some of the most popular indicators they use are oscillators like the Relative Strength Index (RSI) and the MACD.

When an asset gets extremely oversold, contrarians can decide to buy it even when other participants believe that prices will keep rising.

How (and when) to trade contrarian

There is also an important concept of market themes when it comes to contrarian investing. Ideally, investors often look at the market themes and then allocate their funds in the best assets for those themes.

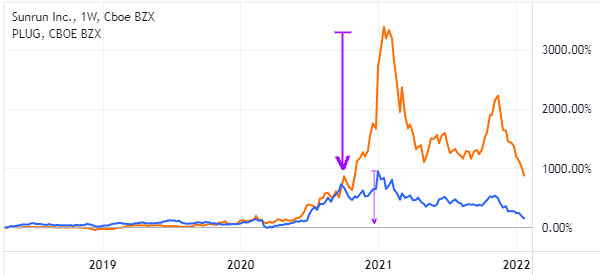

There have been several key market themes recently. For example, there is an ongoing transition to clean energy that has seen investors buy stocks of companies to benefit.

There has also been themes about the metaverse and electric vehicles. At times, when the Fed is expected to hike interest rates, investors tend to allocate funds to companies like banks.

In most cases, stocks in these hots will often rise regardless of their fundamentals. This rally will often happen because investors are not looking at the details of these firms.

In the end, contrarians often take a close look at the fundamentals and short these fast-growing themes. For example, there have been talk about the need for solar power and other clean energy sources like hydrogen.

Sunrun and Plug Power are among the biggest players in solar and hydrogen. Their share prices rose sharply as investors piled in.

However, as shown above, the shares have declined sharply in the past few months. This means that contrarians who shorted these stocks at their tops have made a lot of money.

Summary

Being a contrarian trader or investor can be a difficult thing especially in a period when the market is going against you. There are also several risks that day traders and investors can face.

Above all, day traders, who cannot wait for long recovery times (as was the case here), and must conduct additional analysis before entering a trade against the masses.

In this article, we have looked briefly at how it works and some of the best strategies to use. We hope we have been of some help to you, if you decide to try to be a contrarian!

External useful Resources

- What Is Contrarian Trading, And How To Do It? Strategies And Tips – Nasdaq