An interesting thing happened in the financial market in 2020 year. Most global indices started the year with a bang because most market participants were expecting for a continuation of last year’s gains.

In March, things changed after the WHO declared coronavirus a global pandemic. Most indices dropped by more than 20%. From May, these assets have been rallying, and some have pared back the original losses in short.

This period has been perfect to put in place a strategy to buy stocks that have just suffer a substantial drop while waiting for the price to recover: Buy the Dip.

Such events are not so rare, so knowing this strategy well will definitely give you a nice advantage in terms of profits. In this report, we will look at the buy the dip strategy and how you can use it well.

Table of Contents

What is Buy the Dip Strategy?

As the name suggests, a buy the dip strategy involves looking at a financial asset whose price has suddenly dropped and buying it. By purchasing the asset, you benefit when the price recovers.

The strategy can be used in all types of assets, including stocks, indices, currencies, and commodities.

Warren Buffett is a major proponent of buying the dip on American stocks. He argues that it is almost impossible to go wrong betting on the US economy because the stock market always recovers.

It recovered after the Great Depression, the 1987 crash, the dot com bubble, and also the last financial crisis.

How to use the Buy the Dip strategy

There are several things you need to look when using the buy the dip strategy. First, you need to identify a financial asset that is in a strong upward trend.

Second, you need to identify when the trend ends and the asset declines sharply. This decline could be caused by several factors:

- For example, a company may report a bad quarter, slash its dividend, report the demise of a CEO, and even lose a patent.

- Also, a currency pair may drop sharply after the central bank makes an unexpected decision.

- In most cases, market tends to overreact, which makes the buy on dip strategy ideal.

Third, you need to understand how deep the dip will continue. There are several ways to go about this.

How to identify stocks to buy the dip

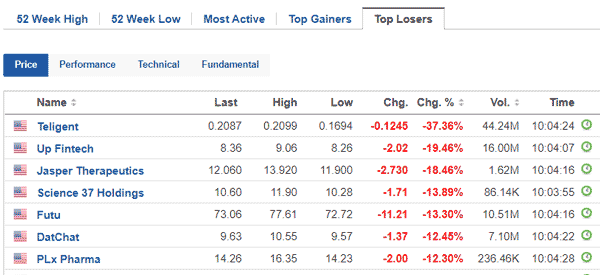

There are several approaches you can use to find good stocks to buy the dip. For example, you could use platforms like Yahoo Finance, WeBull, and Investing.com to find stocks that are falling sharply within a session.

You could also use these platforms to find assets that are trading at the 52-week lows. For example, the chart below shows stocks that have fallen sharply in a session. You can do an in-depth analysis on them.

How to understand how long Dip lasts

Using the Fibonacci retracement

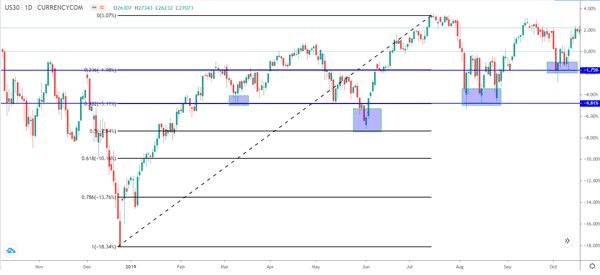

The Fibonacci retracement is an important tool that was developed by the Japanese more than a century ago. Since its calculation is often difficult, you should just know how to apply and use it in the market.

Essentially, you use the Fibonacci tool and connect the highest and lowest point. After you do this, you will see several Fibonacci lines (50%, 78.6%, 61.8%, 38.2%, and 23.6%). So, when you see a sharp decline, you should watch closely at these levels.

If the price moves below 23.6%, it means that bears are in control and you should watch out for the next level at 38.2%.

If it moves sharply below this, it means that it is not time to buy the dip. If it starts going upwards after hitting the 38.2%, it could be a sign that it is time to buy on dip.

A good example of this is shown below.

Using indicators

Another approach of using buy the dip strategy is to use technical indicators like moving averages, Donchian channels, and Ichimoku cloud. For example, you could use a moving average to guide you on when to buy an asset.

In the chart below, we see that the S&P 500 index has been in a strong bullish trend. During all this time, the index has remained above the 100-day moving average. Therefore, when it makes a major pullback, you could buy the dip any time it hits the 100-day moving average.

Using the Dollar Cost Averaging

Dollar Cost Averaging (DCA) is another approach you can use when buying the dips. The strategy is mostly used by people buying and holding a financial asset for a considerable amount of time. Ideally, DCA involves dividing the funds you have and acquiring the asset in a longer period.

For example, assume that the stock price of company A is trading at $20 and that you have $10,000. If you really believe in the company, you can spend all of your money and acquire it.

This means that you will get 500 shares. If the stock climbs and reaches $30, it means that your total funds will be $15,000.

But a stock does not go up in a straight line. It drops and climbs. Therefore, in dollar cost averaging, you divide the funds and buy at several stages.

In this example, you can spend $1,000 and buy the stock at $20. If it drops to $18, you spend another $1,000. You then spend $1,000 if it moves to $15 and another $1,000 if it moves to $12.

If the stock finally recovers and moves to $30, you will make more money than if you used the first method.

Buy the dip vs dollar cost averaging

In the previous sections, we have looked at what buying the dip is and what dollar cost averaging. Buying the dip refers to the situation where you buy a stock or other asset when its price drops sharply. The goal is to time the market and make money when the asset starts rebounding.

Dollar cost averaging, on the other hand, is the process of subdividing your funds and buying an asset over time. It can be viewed as a relatively less riskier strategy of buying the dip.

When it works well, it is possible to make good money using the buy the dip and dollar cost averaging strategies. But as shown below, there are several risks involved.

Is Buying the Dip a good Idea? Here are some Risks

Buying the dip tends to work for most people. Still, it has its own risks especially when used by novice traders.

Slow Recover

The biggest risk is that of buying an asset whose price won’t recover within a short period. For example, if you buy crude oil for about $ 40, hoping that the price will recover and test $ 50, but in a few days it will be exchanged for about $ 25.

The Failure of the Strategy

The second risk is that the strategies used don’t always work. For example, you can buy when the price hits the 50% retracement level hoping that it will turn around. In some cases, the price continues to fall, ignoring the Fibonacci.

Final thoughts

Buying the dip is an important strategy you can use to trade the financial market. Apart from the dollar cost averaging and Fibonacci retracement, there are other strategies you can use, including using indicators and using patterns like triangle, ABCD, XABCD, and head and shoulders.

External Useful Resources

- Should You Buy the Dip Is a Question Only You Can Answer – Bloomberg

- What Happens If You Buy the Dips Every Day – The Balance