The world is changing very fast. Consider this. The smartphone is less than 15 years old. Facebook, and other prominent social media networks are less than 20 years old. Amazon, and other e-commerce platforms are relatively new. All these changes show how fast the world is changing and how the people who invested in the new age companies have accumulated a lot of wealth.

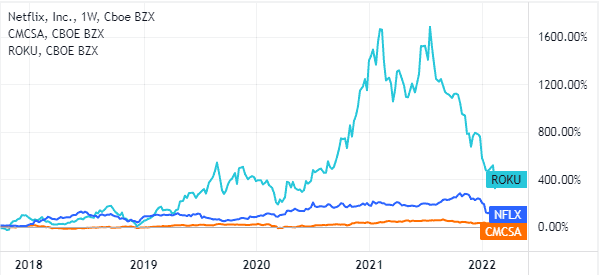

We published this article for the first time in 2019. Some of the sectors we wrote about did really well. For example, at the time of writing, Netflix was worth over $120 billion. Today, it has a market value of over $183 billion.

But Apple, Disney, Comcast, and AT&T have also done well in the streaming business. Also thanks to the acceleration due to the Covid-19 outbreak, which forced us to spend more time at home.

At the time, Tesla was worth less than $100 billion. It is now valued at $1 trillion. Other sectors like cloud computing, artificial intelligence, and ride hailing (Uber and Lyft) have done well. The only one that has lagged is autonomous driving.

We still believe that the original sectors have a long way to grow in the next decades. So, in this update, we will provide more sectors that will likely do well in the future.

Table of Contents

Possible trends for the next years

Pharmaceutical companies

When we did the first part of the article, it was hard to predict the events of 2020. Therefore, we recommend that you allocate some cash in pharmaceutical companies.

They are all-weather companies that do well in all conditions. Notably, the deadlock in Washington means that it will always be difficult to regulate the sector. The notable companies in this regard are firms like Pfizer and Moderna.

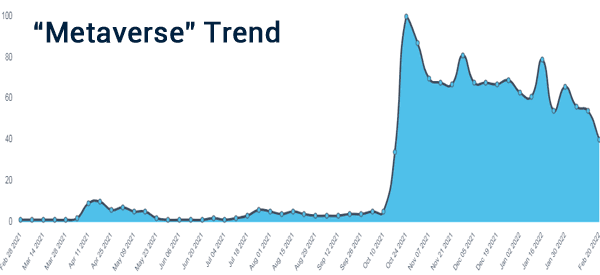

Metaverse

Metaverse is an industry that allows people to interact and do commerce in a whole virtual environment. The industry is expected to grow rapidly in the coming years.

Indeed, Facebook has already changed its name to Meta as a reflection of this industry. Therefore, you might consider allocating funds to metaverse companies like Nvidia and Roblox.

Blockchain

Blockchain is another industry that is expected to grow in future. The idea behind this is simple. Around the world, many young people are concerned about the control that many big companies like Amazon and Google have.

Therefore, there is a likelihood that more people will flock to decentralized platforms. As such, you should focus on companies with a presence in the industry.

One thing above all? NFTs, non-fungible tokens.

Technology

Many areas of the technology industry are expected to grow. Indeed, in our first version of this article, most companies that we mentioned were all in the tech industry. Now, we recommend that you focus on tech companies in areas like fintech and cybersecurity areas.

Artificial Intelligence

Today, we are in an age where artificial intelligence is taking over. This is an industry that is changing how everything works.

In our homes, we have smart speakers that we can interact with and in our smart phones, we have platforms that can help our daily lives automatically.

But nowadays AI is taking over everywhere, even just to make some complex and boring processes automatic. Some stocks to consider? It may sound cliché but you must consider companies like Google, Amazon, and Microsoft.

This exists in trading as well! That’s why We talked about Algorithms that help to automate your trading here.

Clean Energy

A lot of people around the world are moving from fossil fuels. This is because they are now more aware of the climate change debate.

Therefore, this has seen companies that are advancing from fossil fuels do well. Some of these companies are Tesla and Nio.

It’s very likely that the supply chain and energy crises resulting from various conflicts (Russia-Ukraine above all) will push this sector a lot.

See also 5G, focus on which companies to invest in

Summary

Understanding in advance what the trends will be in the coming years is a key activity especially for those who invest in the long term.

But it’s equally important for day traders, because they can focus on studying areas where volatility and liquidity could show plenty of opportunities to generate profits. A good practice is to create a feed (or a watchlist) to keep an eye on the latest news in the sector.