Risk management is an important concept in trading and investments, we’ll never stop saying that. It refers to the process of reducing risks while maximizing returns.

It is a vital thing to have in mind simply because of the amount of risk involved in the financial market, where most inexperienced and experienced professionals lose money.

In this article, we will look at a basic (but still very useful) concept of risk management known as the 2% rule.

Table of Contents

What is the 2% rule?

If you have taken forex or day trading 101, you have likely heard about the concept of the 2% rule. It simply refers to the caution that no trade you execute should expose your account to a 2% loss. As such, if you have a $10,000 account, you should ensure that your trade does not expose you to a $200 loss.

There are other alternatives to the 2% rule. Some risk-averse traders believe in the concept of the 1% rule, where they don’t risk as much as 1% of your account. At the same time, some risk-hungry traders set the rule at 10%, meaning that they are willing to lose 10% of their account in a single trade.

As we will explain later, there are pros and cons of using the 2% in the financial market.

How the 2% rule works

So, how does the 2% rule work? As we have described above, the concept behind the 2% rule is really easy to understand and use.

It works like this. You first check your trading account balance to see where things stand. After doing this, establish where the 2% is. For example, if your account balance is $45,200, then your 2% is $904.

As such, if you are opening just one trade, ensure that you are not risking more than $904. The same is true when you are opening more than 1 trade.

Key concept 1: Stop loss

There are two things you need to know when applying the rule. First, there is the concept of a stop-loss, which is a tool that automatically stops a trade when a certain loss threshold is reached. This is one of the most important tools you have when using the rule (and when You trade, in general).

Key concept 2: Lot size

Second, there is the idea of trading volume or lot size. Ideally, when opening a trade, its volume will determine whether the 2% will work.

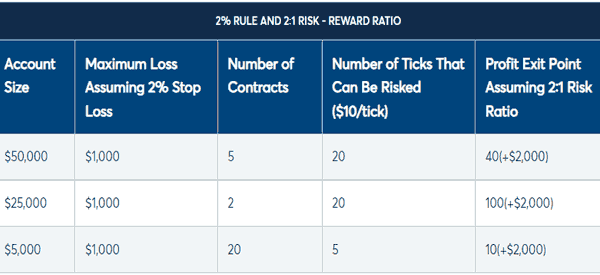

For example, if you have $10,000 in your account and you use a big volume to buy or short an asset, it means that your stop-loss will be triggered significantly earlier than when using a small volume. The chart below shows several scenarios when using the 2% rule in trading.

Risk and reward ratio

An important concept you will find out when looking at the 2% rule is on the risk/reward ratio. In finance, risk/reward simply refers to the amount of money you are risking to generate a certain reward.

For example, if you are risking $2 to make $2, it means that you have a risk/reward ratio of 1:1. On the other hand, if you are risking $2 in order to make $4, it means that you have a risk/reward ratio of 1:2.

Another concept of calculating the risk and reward ratio is to look at your winning ratio. This is where you do a calculation on your typical wins and losses. A trading journal is very important to keep track of this.

For example, you can keep track on the number of trades you open in a day and their outcome. In terms of outcome, you can look at whether the trades generated a win or a loss.

You can then look at this ratio in a period of a week. Within a few months, you will be able to see your average win and loss ratio. Also, you will identify whether this performance has consistency. Therefore, this data will help you to calculate the ideal risk/reward ratio.

2% vs 1% vs 10% rule

As mentioned above, the 2% is not fixed in stone. It is a rule that you can easily change depending on your risk appetite. For example, many people who are extremely fearful about the market have a 1% rule, meaning that they don’t purpose to lose more than 1% of their money.

Other people use the 2%, which is commonly advocated. At the same time, there are those who risk as much as 10%. This simply means that if they had a $1,000 account, they are prepared to lose $100 of their funds.

There are other traders who are extremely risk-hungry, meaning that they risk as much as 50% of their accounts per trade. These can be defined as YOLO trades.

Other risk management strategies

There are other risk management strategies that will help to complement the 2% rule approach. In other words, this rule cannot work well without using these strategies.

First, there is the idea of trade volume. Ideally, the more money that you risk per trade, the more risks you will be taking. If you have a $10,000 account and you decide to use $50,000 to buy a certain stock, it means that you have exposed yourself to substantial risks. Therefore, always ensure that you check out the amount of money you are risking.

Second, there is the concept of stop-loss and a take-profit. A stop-loss, as stated above, will automatically stop your trade when your loss threshold is reached while a take-profit will be the maximum amount of profit you want to make in a trade.

Third, there is the idea of being disciplined. For example, when you set your stop-loss, ensure that you stick with it when trading.

Summary

The 2% rule is an important one when trading the financial market. It allows you to take moderate risks, balancing well between possible losses and the profits you can generate.

In this article, we have looked at what the rule is and some of the top strategies to use (because alone is not so effective). We have also looked at some of the other risk management approaches that you can use with it.

External useful resources

- How much of your account should you risk in trading and why? – Quora