A few months ago, volatility in the financial market was rising as uncertainty about the coronavirus pandemic continued. Many traders benefited from this volatility. However, recently, several financial assets have remained in a range.

A good example of this is crude oil, which has seen little action in the past few week as shown below. In this report, we will look at what a range bound market is and how you can trade it profitably.

Table of Contents

Definition of a range-bound market

A range-bound market is where a financial asset like a commodity, stock, or a currency pair remains in a relatively tight range. For example, if a stock moves stays between $10 and $11 for a few days, it can be said to be a range-bound market.

During this period, it is often difficult to make money because movements tend to be relatively less and the markets have a very low volatility.

» Related: Range trading explained

Why assets get range bound?

A common question among new traders is why asset prices get range bound. There are two primary reasons why this happens.

No Major Catalyst

First, it happens when there is no major catalyst in the market. A good example of this is the crude oil price chart that is shown above.

As you can see, the price rose sharply in May, continued the upward trend in June, and then paused in July. All this happened because there was no major catalyst to push the price higher and lower.

Low Volume

Second, it usually happens when there is little volume in the financial market. A good example of this happens the holiday season, when most traders are not in their trading desks. Some of the low-volume periods are during the Christmas season and during summer.

How to trade in range bound markets

Trading in range bound markets is usually relatively difficult and less profitable. That is because most traders benefit more when there is more volatile in the market. Still, there are several strategies you can use to analyse and trade during these markets.

The overall trend

First, you need to look at the overall trend of the asset that you are trading in. You do this by adjusting the time of the asset in the chart. For example, if you trade using the 30-minute chart, you can adjust this time by looking at the daily chart.

The goal is to see the overall trend of the asset. You can also narrow the chart by looking at the five-minute chart. You will often find that an asset is more volatile when you narrow down the chart. For example, the chart below shows the five-minute action of the same crude oil that is shown above.

Another benefit for adjusting the asset’s time is to check out the key support and resistance points. In other words, doing this will help you identify when an asset is about to have a substantial pullback or breakout.

Have Alerts

Second, when trading during a ranging market, another thing you need to do is to have alerts. Many charting platforms and online trading platforms have alerts tools. These alerts can make it simple for you to know when to enter or exit a trade. Also, you can incorporate stop and limit orders with the alerts.

Meanwhile, since most traders make money during volatile markets, another strategy is to search for assets that have some volatility.

A good example is the Netflix chart shown below. As you can see, while crude oil price had no volatility, the company’s shares had some volatility. Therefore, you can trade Netflix instead of crude oil.

Wait and See

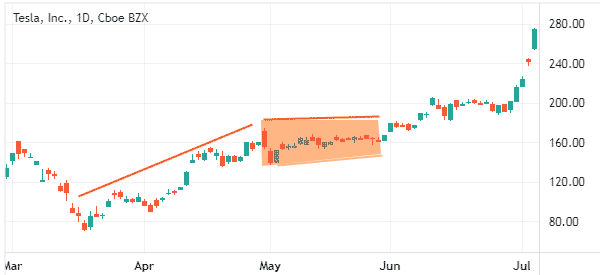

Wait and see is another important strategy to trade during range bound markets. In this, you simply wait for the range to breakout and enter the trade. This is an important strategy because, in most cases, ranges tend to lead to breakouts.

In other words, they are usually the calm before a storm, meaning that the price will likely breakout.

› Key Ways To Be Successful with Breakouts

Range-bound markets trading strategies

As mentioned above, it is often difficult to make money when an asset is in a range. Still, there are several strategies you can use.

First, you could embrace a wait and see approach and then jump in when a trend starts to form. For example, in the chart below, we see that the price of Kadena was a bit unchanged for a while. However, when the price rebounded, it rose by more than 1,000% within a short period.

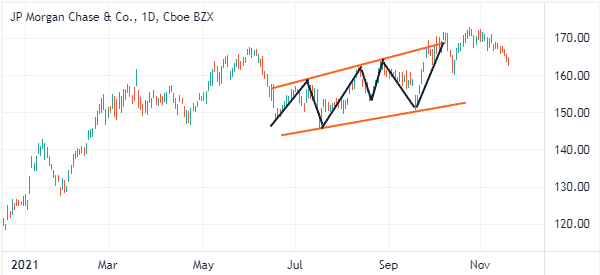

Second, depending on the size of the range, you could make money by scalping. This is where you buy an asset and then sell it when it gains by a few points. You can then short it when it reaches a certain level.

A good way to do this is to draw two trendlines that connect lower and upper levels of the channel. As shown below, you could place a buy trade when the price hits the lower side and a sell trade when it tests the upper side. A good example of this is shown in the JP Morgan chart below.

Final thoughts

Range bound markets can be boring to most people. They really are. Indeed, most investment banks report minimal earnings in the fixed income currencies and commodities businesses when there is no volatility. Using the approaches we have described here can help you maximise your returns during these times.

External Useful Resources

- How To Determine Bound Market – Premeirtardeuniversity

- How to Trade Range-Bound Income Trades in a Volatile Market – Lightspeed