Preparation is an important aspect that determines whether you will become a successful trader or not. Studies show that traders – and all other professionals – who are successful tend to follow a specific routine or plan.

In this report, we will look at how establishing a good trading routine will help you become a better trader.

There are two aspects to this routine. First, there is the routine on time management. Secondly, there is the routine on the trading side of things.

Table of Contents

What is a morning trading routine?

A morning trading routine refers to several things that you do every day before you start trading.

Traders are different, so the first thing you need to do is to determine the type of trader that you are:

- There are those who wake up and go straight to the charts and start trading.

- There are those others who wake up, do morning exercise, and then start trading.

- Also, there are traders who wake up, spend a few hours looking at the news before they start to trade.

We always spend a few minutes looking at the news, with the goal of getting information about what happened at night.

To achieve this, We have a number of websites that we always visit in the morning. These include CNBC, Wall Street Journal, Investing, and Financial Times.

After doing that, we go to the economic and earnings calendar and see the top events that will happen during the day.

Finally, if we are trading stocks, we use screeners to identify the stocks that are moving heavily in premarket trading.

Tip: In most days, we do this routine before we go to bed also.

Benefits of having a good morning trading routine

There are several advantages of having a good morning routine as a trader.

- It will help you become organised. This means that you will always start your day knowing what you want to achieve.

- Having a routine will help you deal with pressures of the market. For example, it will help you have peace of mind when there is too much news in the financial market.

- This will help you know the stocks that you want to trade during the day.

How to create a good morning routine

There are a few steps you need to do when creating a morning routine.

Little advice: if you are a part-time trader, you should ensure that you are trading at a time when you are free. You should desist the temptation of trading during your office hours. Doing this will present you with risks both at work and in your trading.

Read and Understand the Financial Market

First, if you are a new trader, we recommend that you spend time reading and understanding about the financial market. There are many resources that will help you achieve that: books, videos, podcast and financial websites.

The time of the day that you decide to trade should be consistent. For example, if you decide to trade in the European session, you will be able to learn and understand the behaviour of the session.

Have a Strategy

Second, you should come up with a trading strategy. Some of the strategies you can use, among others, are:

- scalping

- day trading

- algorithmic trading

- long-term trading

The strategy you use will determine how your morning routine will be.

For example, if you are a scalper, you don’t need to know more about the news. In this case, your routine could be about checking out the stocks or currency pairs that are making major moves.

Do a Checklist

You should have a checklist for what you are supposed to do before you initiate a trade. This checklist should have all the things that need to happen before you initiate a trade. For example, the checklist can suggest:

- Only open a trade when there is no major economic data expected.

- Only initiate trades of a certain currency pairs, commodities, or stocks.

- Initiate trades when a certain criterion is met. For example, it can tell you to initiate a trade if the short-term and long-term EMA crosses.

- The exact levels where you are required to place your stop loss and take profit.

Test, Test and Test again

Finally, you should put your routine to test by checking out how it is working for you. For example, if you are a full-time trader focusing on the American session, you should spend a few months seeing how this routine is working out.

If the routine is not working out, you can decide to test the European session and see how it will work. By so doing, you will be at a good place to find the best period that you will be trading.

You should also put various assets to the test. For example, you can decide to test the stocks that you will be focusing on.

Some day traders have made a fortune trading penny stocks while others make money trading large-cap stocks. Others specialize on technology companies while others focus on pharmaceutical companies. Therefore, you should spend time testing the most optimum assets to trade.

Also, you should test the performance of your trading journal. This is a document where you write your trading actions down.

It can be a simple document that shows the trades that you initiated and their profit or loss. The journal can also be a complex document that has multiple parts such as the trades you are waiting for, technical indicators used, and the trades outcome.

Examples of a morning trading routine

As mentioned above, your routine does not need to be similar to that of another person. Here is an example of a trading routine that you can have.

- Collect reputable websites that you will be using. These could be Bloomberg, Reuters, CNBC, and Investing.

- Read the news and check out the calendars. These will help you be more organised for the day.

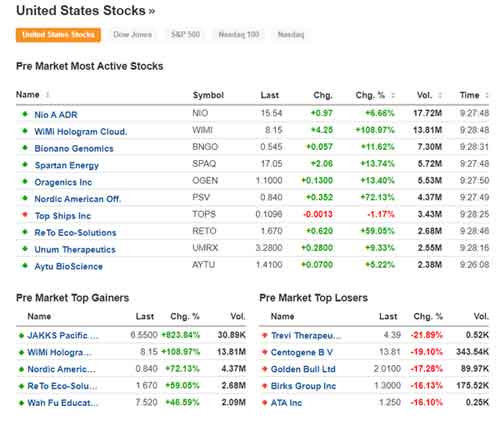

- Use screeners – Use the screeners to find out the companies making major movements as shown below.

- Screen the technical indicators – If you are a chartist, you should go through stocks and other assets that are having major moves and check out the technical arrangements.

Please note: Volume is the most important factor in premarket. Ideally, you should jump in stocks that are moving rapidly but those that are supported by volume.

For example, in the chart above, we see that that WiMi Hologram is up by 108% with volume at 13 million.

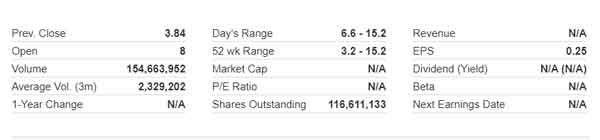

If we open the link, we see that the stock’s 3 month volume is at 2.3 million. This means that there could be some important news.

After this, you should check out the news. Always ensure that you do your research about the reason why the stock is moving higher or lower.

Final thoughts

Having a good morning routine is an important thing if you are to become a successful day trader.

We recommend that you spend a lot of time to come up with yours. It does not need to be like the one we have covered above.

External useful Resources

The Daily Routine of a Swing Trader – Investopedia