Lots are an important concept in forex and CFD trading. They refer to the volume of trades that you will implement per trade. These sizes are different in forex compared to the stock market, where the volume is determined by the number of shares you buy. For example, you can buy 2 Apple shares.

In this article, we wll look at the concept of lot sizes and how you can use it well in the forex and CFD trading.

Table of Contents

Lot sizes definition

A lot size is defined as a measurement that standardises trade sizes in the forex market. This is important because of how the forex market operates.

In forex, the smallest change that a pair can move is known as a pip. For example, if the EUR/USD rises from 1.1200 to 1.1210, it means that it has risen by 10 pips.

Therefore, unlike in stocks, trading one single unit of the forex pair is not feasible or ideal. As such, the forex industry came up with the concept of pips and lot sizes.

As we will explain later, the exposure you decide to use will be very important. Indeed, most traders fail because they don’t have a good understanding of lot sizes and how they work. In most cases, using a larger position will lead to a higher profit or loss.

A good way to understand lot sizes is to look at how companies price some of their products. For example, candly companies don’t expect their customers to buy just one piece. Instead, they have put standard amounts that people are used to buy.

Types of lot sizes in forex

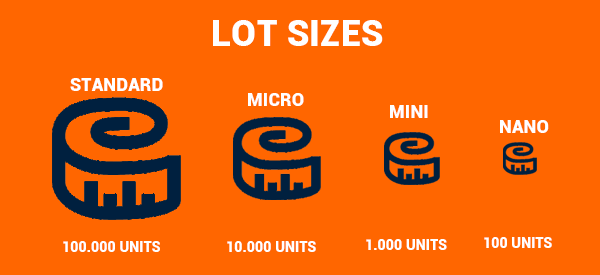

A common question is on how much one lot in forex is worth. This question cannot be answered directly. The answer depends on whether a trader is trading one of the four types of lot sizes in forex: standard, mini, micro, and nano lot.

So, let us have an in-depth look at these types of lot.

Standard lot size in forex

For starters, let us first look at how currency pairs are priced. The most popular forex pair is the EUR/USD. In this, the euro is the base currency while the USD is the quote currency.

If the EUR/USD pair is trading at 1.1200, it means that you can exchange 1 euro for $1.1200. The same can be said as that you need $1.1200 to buy 1 euro.

A standard lot size in forex refers to 100,000 currency units. This is the most commonly used lot size in the financial market.

So, assuming that the EUR/USD pair is trading at 1.1200, it means that one standard lot size of the euro will be 112,000 units. As such, you need 112,000 units of the US dollar to buy 100,000 units of EUR.

Mini lot in forex trading

The other popular type of lot size in forex trading is the mini lot. It refers to 10,000 currency unit of the currency pair.

In the example above, it mans that one mini lot of the pair is 11,200 units. Therefore, you need 11,200 units of USD to buy units of the EUR.

Micro Lot in forex

The micro lot is the next popular type of lot size in forex trading. It refers to 1,000 units of the currency pair.

Using our EUR/USD example, it means that one micro lot of the pair is 1,120 units. You need 1,120 of the quote currency to buy 1,000 units of the EUR currency.

Nano lot in forex

Finally, there is the nano lot. This lot refers to a tenth of the micro lot. In this case, you need 112 units of the quote currency to buy 100 units of the EUR.

What are lot sizes worth in forex?

As mentioned above, the smallest movement of a currency pair is known as a pip. Therefore, assuming thar you are trading the EUR/US pair, it means that a one pip move in a standard lot is worth $10. A mini lot is worth $1 while a micro lot and a nano lot is worth $0.010 and $0.01, respectively.

These figures show that the smaller the lot size leads to a smaller one-pip cost. As such, a small lot will lead to small profits and losses.

What is a lot size calculator?

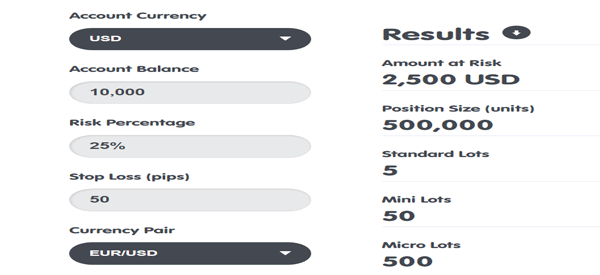

As demonstrated above, it is relatively easy to calculate lot sizes in forex trading. However, you don’t need to do it manually yourself. Instead, you can use one of the popular free calculator.

Several forex brokers provide a position size calculator. Websites like BabyPips and Investing also have these tools that you can use.

All you need to enter is your account balance, risk percentage, pips, and the currency pair you want to trade. A good example of this is shown in the chart below.

Related » The Best Currency Pairs to Trade

Lot sizes in risk management

Risk management is an important concept in day trading. It refers to the process of reducing risks while maximizing returns. It is one of the most useful concepts in the market. One of the best strategies for risk management is using a good lot size.

While a small exposure will not lead to substantial profits, it will also not expose you to substantial losses. As such, it is recommended that you start your trading career with a small lot size and then increase it as you become a better trader.

Using lot sizes in risk management should be accompanied by other approaches like low leverage and having a stop-loss and a take-profit.

Amount of Money you have

You need to carefully consider the amount of money you have in your account. The more money you have, the better it is for you if you wanted to place a large lot size.

For instance, if you have an account balance of $100K, then it would be easier for you to have a lot size of 10. If on the other hand you have an account with $1000, then it would not be appropriate for you to place such a trade.

In the first instance, you can comfortably lose $3000. This is because the margin call will be quite a distance. In the other instance, with the large lot, you margin call will be triggered within a short duration of time.

Therefore, the more money you have gives you an opportunity to place a bigger bet. However, it is always wise to use a small lot size as this helps you protect your money.

Related » How to Become a Successful Trader Starting Small

Duration of the Trade

The amount of time you anticipate the trade to remain open will help you determine the size of the lot size to have. If you want a trade that will last for a few days, then you should have a low lot size.

If on the other hand you want a trade that will remain open for a few minutes or hours, then We recommend that you have a higher lot size.

This is because of the fact that there could be huge movements in the trade. If this happens, in the trade you anticipate to last a few days then you will be protected with the reduced lot size.

Risk tolerance

We have written before on the risk tolerance nature of trading. As a trader, you should always have a profile that determines the amount of money you can be comfortable losing per trade.

You should use this risk tolerance to determine the size of the lot that you are to use. If you are a high risk trader, then you should use a higher lot size. If on the other hand you don’t like taking huge risks, then you should use small sizes.

External useful resources

- What Is Standard Lot? Definition in Forex and Calculating Lots – Investopedia