The stock market is one of the biggest segments in the broader financial services industry. Stocks, also known as shares, represent partial ownership of a publicly traded company. The other popular assets in the market are currencies, crypto, bonds, and commodities.

There are two main ways of making money in the stock market. First, there is trading, which involves buying and shorting stocks and exiting the positions within a short duration. In most cases, day traders hold these positions for less than a day,

Second, there is investing, which is the model favored by leading players in the industry like Warren Buffett, Bill Ackman, and Dan Loeb. It is the practice of buying and holding assets for a few months or years. This article will cover everything you need to know about stocks.

Getting started with stocks

What are stocks?

Stocks are financial assets that represent a partial ownership of a private or publicly traded company. For example, assume that two people contributed the same amount of money to start a company. In this case, all factors held constant, these people will each have equal ownership of the company.

As the firm grows, the two founders may plan to raise additional capital by listing it in an exchange like the New York Stock Exchange (NYSE) or the Nasdaq. After this happens, people can buy and sell shares in the new publicly traded company.

Key stock industries

The main way to categorize different types of stocks is by their market cap. But we will discuss this in detail below. There is another way of sorting stocks based on their industries. The biggest sectors in the USA are:

- Technology – These are firms in the information technology industry. Examples include firms like Tesla, Microsoft, and Google.

- Utilities – These are firms that provide basic services like water and energy to customers. Examples of top utility companies are NextEra Energy, Fortis, and Duke Energy.

- Consumer staples – These companies provide products that most people cannot do without. Some of the top companies in this category are P&G, Colgate Palmolive, and Unilever.

- Consumer discretionary – These companies produce products that are considered non-essential. Examples are Hermes, Louis Vuitton, and Starbucks.

- Financial – These are firms in the financial services industry. They include insurance, banks, asset management.

- Energy – These are companies that provide energy solutions like renewable energy and oil and gas. Examples are firms like Exxon Mobil, Marathon, and NextEra.

There are other types of categories, including materials, industrials, real estate, communications, and health care.

Exchange-traded funds (ETFs)

Another type of stocks is known as exchange-traded funds (ETFs). An ETF is a single stock that tracks one or more financial assets like commodities and futures. For example, the SPDR S&P 500 ETF (SPY) is a fund that tracks all S&P 500 companies while BITO tracks Bitcoin futures.

ETFs now control trillions in assets. There are different types of funds, including sectoral (financials, technology, and utilities), assets (stocks, bonds, and commodities), active and passive, and factoral funds.

Passive ETFs track existing indices while active funds are managed by a management team. Examples of the biggest active funds are JEPI, JEPQ, and SCHD.

Examples of the most popular ETFs in the market are the SPDR S&P 500 ETF (SPY), iShares Core S&P 500 ETF (IVV), Vanguard S&P 500 (VOO), and Invesco QQQ Trust Series (QQQ).

Stock trading taxes

Stock trading and investing usually attract taxes since they generate income. In this case, traders are required to pay the so-called capital gains taxes. The tax rate starts at either 0%, 15%, or 20% depending on your profits.

A short-term capital gains tax is one that is based on stocks bought and held within a year. This tax is the one that most day traders will pay. And this tax is usually dependent on the tax bracket. The seven tax brackets are 0%, 10%, 12%, 24%, 32%, 35%, and 37%. Therefore, your tax will be based on your tax report.

Related » Tax Strategies for Day Traders

Types of stocks

There are thousands of publicly traded companies globally, with most of them being in the United States. These companies can be divided into several categories, including:

Blue chip stocks

These are large companies that have stable revenues and profitability. In most cases, these companies were established a long time ago and often pay dividends.

Some of the most notable blue-chip stocks are Procter & Gamble, Unilever, Apple, and Microsoft.

Growth stocks

Growth stocks refer to companies that are in their early stage. As such, they tend to have faster revenue growth and low profitability.

Unlike blue-chip stocks, many growth stakes, including giant ones like Nvidia and AMD don’t pay dividends. Instead, they prefer using their free cash flow to fund their growth. Examples are firms like Tesla, Fastly, and Nvidia

Penny stocks

Penny stocks are small companies that have extremely low share prices. The most common definition of these stocks are companies that have a stock price of less than $5.

Some penny stocks are good quality companies that are just small. Others are formerly large companies that have seen their shares crash over the years. These stocks can be easily manipulated and they tend to have low liquidity.

Small-cap stocks

Small-cap stocks are companies that are relatively small. In most cases, these are companies that have a market cap of between $250 million and $2 billion.

Other types of stocks using this categorization are mega caps (a market cap of over $200 billion), large cap (a market cap of over $10 billion. Mid-cap stocks have a market cap of between $2 billion and $10 billion.

Pink sheet stocks

These are companies that are traded in the over-the-counter (OTC) market. In most cases, these are companies that don’t want to comply with the listing requirements of larger boards like NYSE and Nasdaq.

While most pink sheet stocks are small companies, many others are large international companies.

How the stock market works

A common question is how the stock market works. This one works in a relatively simple way. First, there is the stock market, which is a venue where companies are listed.

The biggest exchanges in the world are the New York Stock Exchange (NYSE) and Nasdaq. Other well-known exchanges are the London Stock Exchange (LSE), Hong Kong’s HKEX, and Euronext.

Companies list in these exchanges in three main ways, including:

- Initial Public Offering (IPO) – This is a process where a company sells its shares to the public. It is often a long period that involves a roadshow, where the company markets itself to large investors.

- Direct listing – This is a shortcut to the long IPO process. It is a process where a company lists shares held by private investors, employees, and management to start trading in the exchange.

- SPAC merger – This is a process where a publicly traded blank check company merges with a private company.

After listing, anyone can buy and sell shares in companies. However, in the United States, it is impossible for people to buy these stocks directly from an exchange. Instead, you have to use an intermediary like Schwab and Robinhood.

These companies then use market makers like Virtu Finance and Citadel Securities to process these orders. This process is known as Payment for Order Flow (PFOF) and is banned in several countries like the UK.

How to analyze a stock as a day trader

Day traders and investors use different approaches to analyze equities. Investors are mostly focused on a company’s fundamentals. For example, they mostly prefer buying quality companies with a huge moat, strong profits, and good management.

Day traders don’t focus on all that. Instead, they focus on the short-term movements of a stock. In this, they mostly focus on technical analysis, which involves using technical indicators and unique chart patterns.

Examples of the most popular technical indicators are moving averages, VWAP, Relative Strength Index (RSI), and Stochastic Oscillator.

There are many patterns that can help you decide when to buy and sell stocks. Some of the most notable patterns are triangles, head and shoulders, wedges, rectangles, and double-top and bottoms.

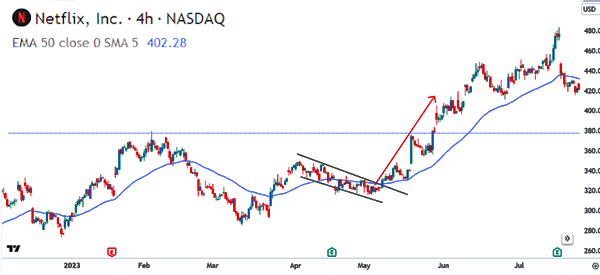

A good example of all this is shown in the chart below. As shown, the Alphabet stock price formed a slanting triple-bottom pattern before starting a major bull run.

It remained above the 50-day moving average as the bullish rally continued. In this case, a trader would have bought and held the stock as long as it was above the moving average.

How to start day trading stocks

Select a broker

The first step you need to do when starting stocks trading is selecting a broker. Fortunately, there are many quality brokers in the market today. In the United States, the most popular brokers are companies like Robinhood, Schwab, Fidelity, Interactive Brokers, and TD Ameritrade.

International customers can decide to select one of the many CFD brokers. Ideally, you should select a broker that has adequate stocks and one that has little or no commissions. Most American companies don’t charge commissions.

Alternatively, you can select a prop trading firm like Day Trade the World (DTTW). In prop trading, you will be trading using the company’s funds and then keep most of the profits.

Open and fund an account

The next step is where you create your account. In most cases, you only need to submit your email, phone number, and your name. Also, most companies will need you to submit your identification details like ID and proof of residence.

After this, you need to select the type of account you want to create. You can create a cash account, which uses only the funds in your account to trade. The challenge for a cash account is that many stocks have become so expensive these days. As such, you need a lot of money to trade profitably. Another challenge with a cash account is that you can only open buy trades and you can’t short.

Alternatively, you can open a margin account, where the broker will lend you cash to trade. Using margin is recommended because it can help you have more profits.

Start with a demo account

You should always start trading with a demo account before you risk your real cash. A demo account is similar to a live account with the only difference being that it only has virtual cash.

This account is essential when you are creating and backtesting your trading strategy. You should only start trading with real cash when you have backtested your account well.

Stock trading approaches

As mentioned above, there are two main approaches to analyzing stocks: fundamenal and technical analysis. Although for day traders diving into the first method is virtually useless, being aware of what can move a particular asset is essential.

Fundamental analysis

Fundamental analysis is the process of looking at a company and estimating whether the stock will go up or down. In investing, this process involves looking at several important things like:

- Company’s moat

- Management team

- Earnings

- Latest news

- Valuation

Some of the things to look at when considering a company’s valuation are the price-to-earnings (PE), price-to-sales (PS), EV to EBITDA, and Discounted Cash Flow (DCF).

In most cases, these metrics are used by long-term investors. For day traders, the best way to conduct fundamental analysis is to look at the news of the day and then find the trading opportunity.

Technical analysis

Most day traders focus on technical analysis to find trading opportunities. This approach has three key parts:

- technical indicators

- chart patterns

- candlestick patterns

Technical indicators include tools like moving averages, the Relative Strength Index (RSI), VWAP, and the MACD.

Candlestick patterns are unique formations that can help you predict a reversal or a chart continuation. The most popular candlestick patterns are harami, morning and evening star, doji, bullish and bearish engulfing, and hammer.

Chart patterns, on the other hand, are unique patterns that happen over some time. The most common continuation chart patterns are bullish and bearish flag and pennants, rising and falling wedge, cup and handle, and ascending and descending triangles.

Some of the most notable reversal chart patterns to look at are double and triple bottoms and tops, head and shoulders, and rounded bottoms.

Executing trades in stocks trading

The next important thing to consider is how to execute trades in stocks trading. First, let us look at the order types:

Market order

A market order is one where you direct the broker to open the trade at the current price. This order is executed immediately and can only be executed in the regular trading session.

The most important con for using a market order is slippage, which happens when a stock is executed at a different price than the one you executed.

Pending orders

Pending orders is where you direct the broker to execute a trade when it reaches a certain point. The two main types of pending orders are limit and stop.

A buy limit order is where a bullish trade is executed at a lower price. For example, if a stock is trading at $10, you can place a buy-stop at $9 if you expect it to drop and then resume the bullish trend.

A sell limit order is where you place a short trade above the current price. In the example above, you can place a short order at $11.

A buy-stop, on the other hand, is placed above the current price. In this example, you can place a buy-stop at $11.

Pending orders are ideal because they help reduce the risk of slippage and you don’t have to wait until your target price is reached to execute the order.

Trading hours in stocks trading

Unlike other financial assets like forex and cryptocurrencies, stocks are traded for a limited number of hours every day. In most countries, the stock market is open for less than 8 hours every day. In the United States, the regular session starts at 9:30 a.m. and closes at 4 p.m. This is the most active session in the market.

The US also has the pre-market and extended hours. The pre-market session starts at 4 a.m and the extended hours session goes until 8 p.m. This means that Americans have adequate time to trade the stock market.

The challenge with extended hours is that you can only place pending orders. Also, the sessions tend to be highly volatile and with limited volumes.

Common strategies for stocks trading

Stock traders use different strategies in the market. Some focus on trend-following, where they buy and hold into an existing trend. Others aim or reversals, where they seek to buy or short when they expect a change in direction. Some traders also focus on breakouts and news.

News trading

This is a strategy that involves reacting to market news. There are two important types of news: breaking and expected news. We define breaking news as any new information that has an impact on a stock or stocks. Examples of these news are mergers and acquisitions (M&A), management change, and a natural disaster.

Expected news are those that traders expect to come like earnings and economic data. In most periods, stocks tend to be highly volatile after earnings. Therefore, some traders have created a strategy for trading these news events.

Related » Breaking news vs price action

One of the strategies is to place a bracket order before the earnings release with the hope that one of the pending orders will be executed. The other approach is to wait for the initial price action and then move in. For example, if the stock jumps by 10% after earnings, you can short it and make money as it stabilizes.

Trend following

Trend-following is a trading strategy where people look at existing trends and move in. The goal is to ride the trend whether bullish or bearish. There are a few ways of doing this.

First, you can use popular trend indicators like moving averages and Bollinger Bands. For example, you can buy a stock and hold it if it remains above a certain moving average. A good example of this is shown below.

There are several other trend-following indicators you can use, including Ichimoku cloud, Bollinger Bands, and Parabolic SAR.

Second, you can use continuation chart patterns to enter trades. For example, a bullish flag or a bullish pennant can be a sign that the existing trend will continue. In this case, you can place a buy trade until you see a sign of reversal. Third, you can wait for a pullback and enter a position.

Reversals

The other stocks day trading is known as reversals. It is similar to trend-following, with the only difference being that traders seek to enter positions when an existing one is ending. The best way to do this is to use chart patterns like double-tops and bottoms or head and shoulders patterns.

It is also possible to use technical indicators to trade reversals. For example, one can use oscillators like the Relative Strength Index (RSI) and the Stochastic to find overbought and overbought levels.

Alternatively, you can use trend indicators like moving averages to find reversals. The best approach is known as the golden cross, which involves using a fast and a slow-moving average. Finally, you can use reversal candlesticks and chart patterns to identify these reversals. A good example of this is shown below.

Breakouts

The other stock trading strategy is known as breakouts. A breakout is a situation where a stock in a consolidation makes a breakout and starts a new trend. There are numerous ways to trade these breakouts. One of them is to place buy-stops and sell-stops above and below the channel. The other approaches are continuation and reversal breakout strategies.

How to pick and trade a stock

There are thousands of stocks in the market. There are over 58,000 publicly traded companies in the world, with most of them being from the United States. Therefore, selecting the companies to trade can be a bountiful task. Here are some of the top strategies to do this.

Pre-market movers

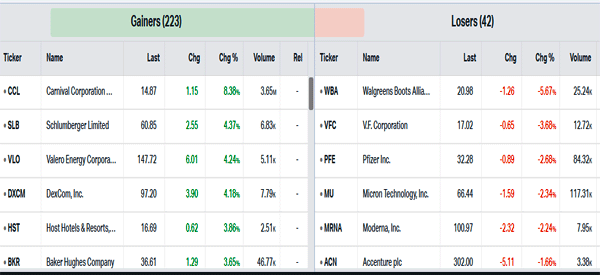

The most common approach to finding stocks to day trade is to identify pre-market movers and companies nearing their 52-week highs and lows. After finding these stocks, you can move ahead and do more research on them. The chart below shows some of the top pre-market movers and gainers (they are not up-to-date in real time).

Use a watchlist

The other strategy for finding stocks to trade is using a watchlist. A watchlist is a list of stocks that you focus on. You can create a watchlist by narrowing stocks based on numerous characteristics like market cap, sector, revenue growth, and even technicals like moving averages.

The chart below shows a watchlist that sorts companies valued between $1.41 billion and $6.9 billion that have a strong buy rating.

Analyze the stock

The next stage for selecting a stock to trade is to analyze one or more that meets your criteria. Ideally, you should go for a company with major moves during the premarket, and one with a high relative volume. The company should have a clear catalyst such as earnings, news, or even a technical one.

An important part of this analysis is known as a multi-timeframe analysis. This is a process where you look at a chart in at least three time frames. The benefit of conducting a multi-timeframe analysis is that it helps you understand the general trend of an asset. It is also a good way for you to identify support and resistance levels.

Finally, use your analytical skills to predict the next price action for the stock. In this case, you can use the approaches mentioned above, including using technical indicators like moving averages and the Relative Strength Index (RSI). Also, you can identify trends, reversals, and breakout opportunities in the stock. In other words, this is the stage where you apply your trading strategy to trade the stock.

Risk management strategies in stocks trading

Risk management is a core aspect in day trading. It refers to a process where you mitigate risks that emerge when you are trading. It is a recognition that all trades have an equal chance of making a profit or losing money. There are several risk management strategies to consider when day trading, including:

Position sizing

Position sizing is the process of selecting the right size for your trade. In general, a big trade position will lead to a big profit if things go your way. However, it will lead to a bigger loss if the stock moves against you.

Therefore, you should open relatively small trades. Doing this will make you modest profits but will also help to protect your account in the long term.

Leverage

Leverage is an important part of day trading because it boosts your potential profits if things go your way. However, the reality is that higher leverage can lead to bigger losses. Therefore, you should ensure that you are not too leveraged.

We have seen the negative impacts of leverage on a bigger scale. For example, Archegos, a family office run by Bill Hwang collapsed, leading to over $20 billion in losses in about 2 days because of excessive leverage.

Therefore, you want to limit the leverage that you use. We recommend starting with a small leverage and then gradually increase it as you gain more experience.

Use stops

The next important aspect in risk management is to use stops. There are three main types of stops in the market: take-profit, stop-loss, and trailing stop. A take-profit is a tool that stops a trade automatically when it reaches a certain profit level. For example, if you open a buy trade at $10, you can place a take-profit at $11.

A stop-loss is a tool that stops a trade when it loses a certain amount of money. In this case, you could place a stop at $9. This means that the stock will be stopped automatically if it moves to that level.

A trailing stop is similar to a real stop-loss, with the only difference being that it moves with the asset price. As such, if the stock rises and then reverses, the trailing stop ensures that these profits are captured.

Diversification

The other approach to do risk management is known as diversification. This is a process where you focus on a few stocks every day. For example, you can decide to focus on at least four stocks in a day.

In this, you can buy a few three and short ones. If the market goes up, your bullish trades will be profitable and the bearish trade will make a loss. The profit will be the spread between the profits and losses.

Common mistakes for stocks trading

Day trading can be a highly profitable way of making money. However, the reality is that most people fail. Studies show that more than 80% of all people who start trading fail. This happens for several reasons. Some of the most common mistakes that many day traders do are:

Fall in love with a stock

Some traders get emotionally attached to a stock and by doing so, make some important mistakes. For example, some traders love stocks like Apple and Tesla so much that they are not open to short them even when market conditions change.

You can prevent this mistake by simply basing your decisions on the key facts of the day. For example, if a stock like Tesla makes a death cross, it is a sign for you to short it.

Timing the market

The other common mistake that people make is known as timing the market. This is a strategy where a trader attempts to get the best price for the stock. The best way to look at the concept of timing the market is when a stock rises by 10% in a session. In This case, you can time the market by attempting to go against the trade.

Most studies show that timing the market fails. Therefore, you should work hard to avoid doing this and instead focus on your core trading strategy.

Trading without a strategy

Many stock traders fail when they do so without a solid strategy. A common approach is where people buy and sell stocks without doing any analysis. In most periods, a trader will simply buy a stock that is rising and short the one that is crashing. Doing all this without doing in-depth research will often lead to a big loss.

Following the crowd

The other common mistake that many day traders make is that they follow the crowd or the herd. This is a situation where they believe that the majority is right. We saw this situation well in 2020 during the meme stock era when companies like GameStop and Bed Bath & Beyond surged. Most people who bought these stocks at the time suffered big losses.

Therefore, we recommend that you focus on doing in-depth research, focusing on your tried and tested strategy, and having stops.

Risk management failures

Meanwhile, the lack of following the best risk management strategies leads to huge losses. This includes the risk management approaches mentioned above. For example, having large leverage, opening large trades, lack of diversification, and failing to add stops can lead to substantial losses in marketing.

Psychological pitfalls

Last but not least, many traders make the mistake of psychological pitfalls when trading. Some of these pitfalls are:

- Fear and greed – These two aspects can lead to substantial profits and losses in the market. A trader who is greedy will want to make more money by opening large trades and exposing themselves to more risks. Fear can also lead to failure such as when a trader closes a loss-making trade prematurely

- Common biases – The other pitfalls are known as biases. The most common of these biases are overconfidence bias, anchoring bias, status quo, and optimism/pessimism bias. You should work to limit these biases.

- Hype – The other psychological pitfall to have in mind is hype. This is related to the fear of missing out (FOMO) and following the crowd.

FAQs

Stocks vs shares: any difference?

A common question among traders is whether there is a difference between a stock and a share. The two words are used interchangeably and often mean the same thing. The difference is that shares show the ownership of a company while a stock is the unit or the actual asset you have bought.

Can I trade stocks with a full-time job?

Yes, it is possible to use day trading as a full-time job. This is possible because it is possible to trade with your smartphone. Most importantly, financial assets like forex and cryptocurrencies are offered for 24 hours. Robinhood has also started offering American stocks for 24 hours every Monday to Friday.

Can I trade stocks under an LLC?

One of the most important approaches to growing your trading business is to register it as a business. The benefit of doing this is that it will help you raise funds from outside investors. It will also help you in taxes since an LLC can take deferred taxes and the carried interest loophole.

How to start trading on a small budget

It is possible to start trading on a small budget. For one, many brokers now make it possible for one to trade without a lot of money. Fortunately, many of them provide leverage, which they can use to amplify their profits.