The earnings season is an important period in the financial market. It happens when most companies in the S&P 500 index publish their quarterly results.

The season happens four times per year in January, April, July, and October. We have written about the earnings season in depth in this article. As you can easily guess, these periods are really interesting for traders because they can make huge profits using the right strategies.

The right ones, in fact. Here’s why in this piece we will explain the best earning season trading strategies to use.

Table of Contents

What is the earning season?

American publicly traded companies are mandated by law to publish their earnings statements after every three months. The goal of these disclosures is to provide shareholders with information about their operations.

The three-month timeline is a highly debatable thing. Some stakeholders believe that quarterly results bring short-termism in corporate America by letting companies focus on short-term profits. Some companies are often not willing to make long-term investments because doing so will have an impact on earnings.

The earning season is usually characterised by large swings in the stock market. This happens since companies tend to provide more news about their operations and forward guidance.

The earnings calendar

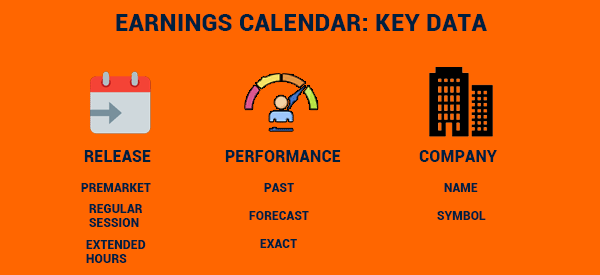

The earnings calendar is an important tool used by traders and investors. It is mostly provided for free by leading websites and brokers like Fidelity and Webull. The earnings calendar provides a schedule for companies that will publish their results.

Related » How to exploit an economic calendar

The earnings calendar is made up of three key parts. First, it has the date when the firm will deliver the results. Since companies don’t have a specific time when they publish, the calendar usually identifies the time in terms of pre-market, regular session, and extended hours.

Pre-market publishers are companies that publish their results before the market opens. Regular session companies publish during the regular session. Finally, post-regular publishers are those that release their results after the market closes.

Second, the calendar has the past, forecast, and the exact. The past numbers are the revenue and earnings per share. Forecasts are what analysts are expecting while the exact figure is what the companies publish.

The third and last one is obvious: the company name and the symbol you have to look for in your software to make the trades.

Stocks performance..

..before earnings

In most cases, stocks show some unique patterns before they publish their results. In the run-up to the company’s earnings, some shares could be in a bullish momentum. This happens when investors anticipate that a company will publish strong results.

For example, if Morgan Stanley publishes strong results, there is a likelihood that Goldman Sachs shares will rise sharply in the run-up to its earnings. This happens in other companies that have a close similarity.

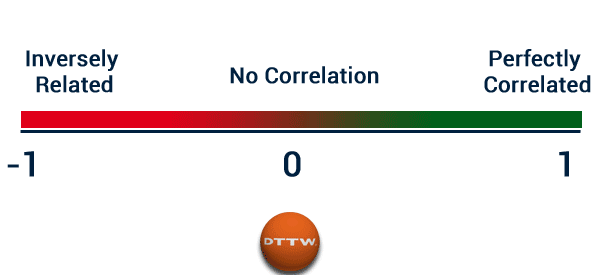

Related » Correlation in trading

In other cases, when a company like Meta Platforms publish weak earnings, there is usually a high likelihood that Alphabet will deliver weak results as well.

..after earnings

The earnings season is usually characterized by significant market moves. These moves happen because of the important news that companies publish during their earnings.

There are three possible ways that stocks trade after earnings. First, some stocks go parabolic when companies publish their results. This happens when a company publish strong results and forward guidance.

Second, some stock end to decline sharply when they publish their results. This happens when companies publish weak results and guidance. At times, a stock can sink even after it publishes strong results. This usually happens when the company provides a weak guidance.

Third, some shares tend to consolidate when they publish their earnings. This consolidation happens when a company publishes mixed results.

The best earnings trading strategy

Traders use several trading approaches during earnings. In this section, we will explain the best earnings season trading strategy. It is based on the concept of pending orders.

For starters, there are two types of orders in the financial market: market and pending order. A market order is one that is executed at the current price.

On the other hand, a pending order is one that is executed at a pre-determined level. Examples of these orders are limit and stop orders. A buy limit order is placed below the market price while a sell-limit is where a short trade is placed above the current price.

How to use pending orders in earnings

Using pending orders is often a risk-free trading strategy to trade the earning season. As mentioned above, traders use the earnings calendar to determine the companies that are about to publish their earnings. Also, we have noted that companies tend to either go vertical or sink after they publish their results.

Therefore, a trader can open a bracket order before the market closes. For example, the chart below shows that Meta Platforms stock was trading at $130 before it published its results.

In this case, a trader would have opened a sell-stop at a level below $130 and a buy-stop above the level. In our example, we have placed a sell-stop at $124 and a buy-stop at $138.

After setting these levels, you should place stop levels. For the bearish trade, you could place a take-profit at $115 and a stop-loss at $138. On the other hand, for the bullish trade, you could place a take-profit at $145 and a stop-loss at $120.

After doing this set-up, your work will be to wait. In our example, we see that the Meta Platforms stock crashed after earnings. Therefore, your bearish trade will be profitable while the bullish one will not be triggered.

Other earnings trading strategies

There are other trading strategies you can use to trade earnings. For example, you can use a strategy known as fading, where you wait for the earnings gap and then take the opposite direction.

For example, as shown above, the stock faded the down-gap and resumed the bullish trade. The only problem with this approach is that it tends to be relatively risky since a stock can continue rising or falling after earnings.

Summary

In this article, we have looked at the concept of trading a company’s earnings. We have explained the best and most risk-free trading approach to use when trading these results. The biggest risks when using the pending order strategy is where the trade is executed and then a sharp reversal happens.