Forex and cryptocurrency trading are popular methods of making money in the internet. Today, millions of people use the two methods on a daily basis.

In this article, we will address a common question that exists among new traders. Specifically, we will compare forex vs crypto and establish similarities and differences between the two.

Table of Contents

What is forex trading?

Forex trading is a process that involves buying and selling currency pairs with the goal of generating a profit.

The idea behind this is relatively simple. For example, currencies are moved by different factors such as inflation and interest rates. Therefore, if you buy one currency, you will benefit as its price rises against the other.

You are participating in the forex market without even knowing about it.

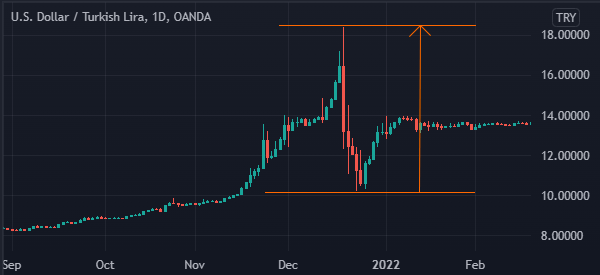

For example, in the chart below, we see that the USD/TRY pair has risen by more than 50% from its lowest level in December 2021. Therefore, it means that people who had savings in Turkish lira saw their purchasing power drop by half between December and May.

In forex, people trade currency pairs, The three main types of these pairs are:

- Currency majors – These are pairs made up of developed world currencies together with the US dollar. Examples are EUR/USD, GBP/USD, and USD/JPY.

- Currency minors – These are pairs that combine developed country currencies but avoid the US dollar. They are EUR/GBP, GBP/AUD, and EUR/CHF.

- Exotics – These currency pairs are made up of developed country currencies and developed world currencies.

What are cryptocurrencies?

Cryptocurrencies are financial assets built using the blockchain technology. They have been around for slightly over a decade.

These digital currencies differ from traditional currencies is that they have a fixed amount of supply and they are mostly not managed by a single entity like the Federal Reserve and the European Central Bank.

According to CoinMarketCap, all cryptocurrencies in existence have a total market cap of over $1.2 trillion. This figure tends to change periodically depending on their performance.

Forex vs cryptocurrencies: top differences

Market size

There are many differences between forex and cryptocurrencies. First, there is the difference of their sizes. As mentioned, cryptocurrencies have a market cap of over $1.2 trillion. Traditional currencies, on the other hand, are much bigger because they are the means of exchange.

Besides, a central bank has no limit about the currency it can print. For example, during the Covid-19 pandemic, the Federal Reserve printed over $4 trillion worth of dollars in a bid to maintain stability in the market. It did this using its quantitative easing (QE) process.

Liquidity

Second, there is the issue of liquidity in the forex and cryptocurrency industry. Liquidity refers to how easy it is to exchange one financial asset with one another.

Because of the volume involved, forex and cryptocurrencies are highly liquid financial assets. However, they both have different levels of liquidity.

For example, top cryptocurrencies like Bitcoin, Ethereum, and Ripple are highly liquid. The same is true among the top forex pairs like the EUR/USD, GBP/USD, and USD/JPY.

Likewise, many cryptocurrencies and forex pairs are highly illiquid. The danger of trading these illiquid forex and crypto pairs is that they have high transaction costs.

Available assets

Another difference that should not be underestimated is the number of tradable assets. Despite the enormous volume that moves the forex market every day, the number of pairs to be traded is quite limited even considering the exotic ones.

This is not true for cryptos. There are more than 14.000 cryptocurrencies currently available!

In short, Bitcoin, Ethereum, Binance, Solana, and Cardano are the most popular and the ones with the most activity, but they are only the tip of the iceberg.

Risks involved

Third, there are risks involved when trading both cryptocurrencies and forex. However, there are more risks in crypto because there is a risk of a coin moving to zero. As shown below, Terra, which was once trading at $120 is now trading at $0.00030.

There are also risks of market manipulation and pump and dump schemes in cryptocurrencies.

Trading hours

Another main difference between forex and cryptocurrencies is on the number of trading hours involved. The two assets are known for having more hours than stocks. Forex is offered on a 24-hour basis every day from Monday to Friday. On the other hand, cryptocurrencies are offered on a daily basis.

Regulations

Regulations play an important part in the financial market. The forex market is highly regulated by entities like the Financial Conduct Authority (FCA), ASIC, and CySEC. Some of the top regulations on the amount of leverage that is offered to traders and negative balance protection.

On the other hand, countries are still coming up with crypto regulations. The fact that digital coins are loosely regulated means that they pose more risks than forex.

Scam risks

The forex and cryptocurrency industries are all rife with scams. Indeed, in the past few years, many people have lost millions of dollars in the two industries. For example, scams in the forex industry include fake bots and brokers.

However, in the past few years, the number of crypto scams has been on a sharp uptrend. In fact, real cryptocurrencies are scams that serve no purpose at all.

» Related: How to Avoid Day Trading Scams

Forex vs crypto: which is more profitable?

This is a common question among new traders. The reality is that this is a relatively difficult question to answer since the number of profits depend on traders themselves. Some traders have found it highly profitable to focus on the forex market while others have succeeded in the crypto industry.

However, in terms of long-term investments, cryptocurrencies have been more profitable. For one, Bitcoin moved from less than $5 and rose to near $70,000.

Pros and cons of forex and crypto

There are both pros and cons of forex and cryptocurrencies. In cryptocurrencies, the pros include the fact that they are offered on a 24-7 basis. Also, there are thousands of digital coins in the market today.

Further, since they are more volatile, many traders are able to find trading opportunities.

The cons of cryptocurrencies are the significant scams available and the fact that the industry is less regulated and a higher level of risk associated with high volatility.

Forex has its pros and cons. For example, the industry is more regulated and has fewer scams than crypto. This results in more stable pairs and more predictable results.

The con is that most people (in particular, novice trader) who trade them fail, even though the profit margin is lower than that of cryptos. The higher regulation also represents an entry barrier that not all traders can face.

Why is forex better?

There are several reasons why forex is better than cryptocurrencies. First, the forex industry has been around for decades and is, therefore, more stable than cryptocurrencies. Second, while the industry is volatile, it is less prone to market risks.

Additionally, it has a higher volume than cryptocurrencies. The daily average of forex is more than $5 trillion. This is significantly higher than the total market of cryptocurrencies.

Related » All the technical indicators you need to master in forex

Summary: The better option for a day trader?

In this article, we have looked at some of the differences between forex and cryptocurrencies. While the two are highly-risky assets, we have seen that forex is much better for most traders.

What if the comparison was between crypto and stocks instead?

External useful resources

What is more realistically profitable, Forex or cryptocurrency trading? – Quora