The Market Facilitation Index (MFI) is one of the several indicators that were developed by Bill Williams. His other indicators are the alligator, awesome oscillator, fractals, and gator oscillators. These indicators are provided by most trading platforms like the MT4 and MT5 and TradingView (but not on PPro8™).

Please note. This indicator is not available in PPro8.

In this article, we will look at the MFI indicator, how it works, how it is calculated, and some strategies of using it.

Table of Contents

What is the Market Facilitation Index?

The MFI indicator was developed to show the relationship between the current price of an asset and its volume. As you possibly know, volume is an important concept since it gives you an indication of how money is moving in and out of a financial asset.

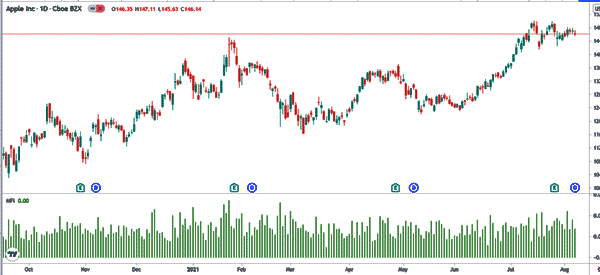

Indeed, liquidity is one of those things that you should always focus on when trading. A highly liquid market is considered to be more effective. Therefore, the MFI indicator shows the change of price for one tick. When applied in a chart, the indicator appears at the lower side. It is made up of several bars, as shown below. Some platforms provide these bars in several colours.

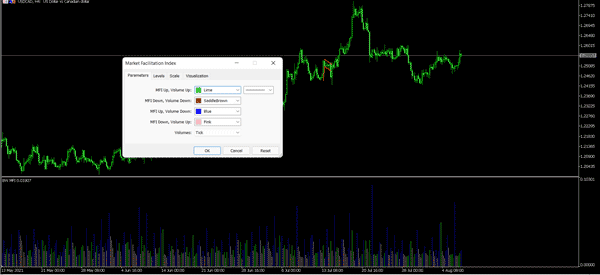

The MFI indicator provided by MT5 is different from the one provided by TradingView. The chart below shows the indicator applied in the MT5 chart. We have also highlighted the different settings.

How the MFI indicator is calculated

The MFI indicator is calculated in several steps. First, you just need to subtract the low level and high level of an asset in a certain period. You should then take this figure and divide it with the volume.

| MFI = (High – Low) / Volume |

Unlike many other technical indicators, there are no settings for the MFI indicator. The only thing that you can tweak in the indicator is the colour of the bars. You can also leave them as they are.

Interpreting the Market Facilitation Index

How then, do you interpret the Market Facilitation Index?

Liquidity

Unlike other indicators, interpreting this one is a relatively difficult thing since there is no specific range for you to look. Ideally, when the MFI index and volume falls, it means that liquidity in the market is fading. Therefore, if the asset has been in an upward trend, and the MFI index is declining, it is a sign that a potential reversal is about to happen.

MFI rise/volume decline

Another scenario is when the MFI indicator is rising while the asset’s volume is declining. As we have looked at other indicators like the RSI before, this is a sign that the price action is not being supported by volume. As a result, this is a sign that a bearish reversal may happen.

MFI decline/volume rise

The third common scenario when trading using the MFI indicator is when it declines while the volume is rising. This is a signal that bulls and bears are battling it out. At times, this will likely lead to a bullish breakout.

How to use the Market Facilitation Index

The theory part of the MFI index sounds good. However, in reality, it is one of the hardest indicators to use. In fact, it is a relatively difficult thing to find trading signals using the indicator. Therefore, we recommend that you focus on other indicators like the RSI and moving averages.

Bullish signal

As mentioned above, you should look at several scenarios when using the indicator. According to Bill Williams, when the MFI and the volume are rising, you should take this is as a bullish signal. That’s because it shows that the volume and price are moving in the same direction.

Sell signal

The next trade signal comes about when the volume and the MFI are falling. This is a sign to sell since it shows that interest in the asset is fading.

Further, there is a period when the MFI is rising while the volume is falling. This situation is known as fake and is a sign that price moves should be taken with a grain of salt. The same is true when the MFI is falling while volume is rising.

Summary

The Market Facilitation Index is one of those proposed by Bill Williams. In this article, we have looked at how it works and how it is calculated. However, as we have shown, it is a relatively difficult to use indicator.

Therefore, since our aim is to give you the best advise, we recommend that you use it wisely and sparingly.

External Useful Resources

- Market Facilitation Index – Forex Technical Analysis – Tradingpedia