A range-bound market is one that is basically struggling to find direction. For example, if a stock hovers between $10 and $12 for an extended period, it can be said to be ranging. Similarly, if the stock is rising or falling slowly, the situation can be said to be ranging.

In this article, we will look at some of the key options you have during a ranging market.

Table of Contents

What is a range-bound market?

A range-bound market is a relatively popular phenomenon that mostly happens after a major market rally. The situation is characterized by little movements in key stocks or an asset. In general, a range-bound market typically refers to the performance of the major indices like S&P 500, Nasdaq 100, and the Dow Jones.

A sector like oil and gas or finance can also be said to be ranging. Additionally, a single stock like Apple, Berkshire Hathaway can also be said to be range-bound. Similarly, cryptocurrencies like Bitcoin and Ethereum can also be said to be range-bound.

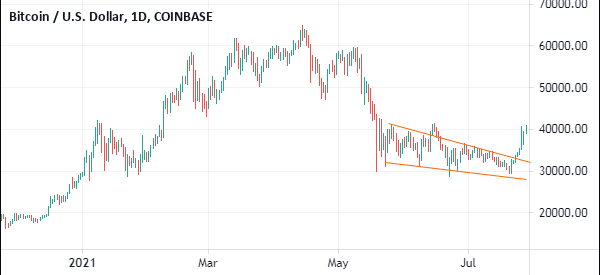

A good example of this is shown in the chart below. The chart shows that the Bitcoin price remained in a range after surging to an all-time high of $65,000.

Ideally, most traders hate range-bound markets because they are the least profitable. In fact, many investment banks like Goldman Sachs, Morgan Stanley, and JP Morgan reported relatively weak trading results in the second quarter of 2021 as stocks remained in a relatively tight range.

Range and volatility

A market that is not trading in a range can be said to be either volatile or trending. A trending market is one that is constantly moving upwards or downwards.

For example, in the chart above, we can see that Bitcoin was moving in an upward trend between December 2020 and mid-January 2021. This is usually an ideal period to trade because you can easily buy an asset and profit as its price rises. Similarly, you can short the asset that is moving in a downward trend and profit as its price falls.

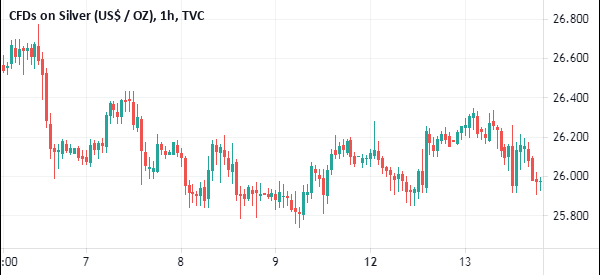

A volatile market is one that is seeing substantial gains and losses in a given period. For example, a stock that rises by 5% today and then falls by more than 7% tomorrow and then rises by 10% a day after can be said to be volatile. A good example of a volatile asset is shown in the silver chart below.

A volatile market is usually much better for professional day traders. That is because it means that they can open a trade now and exit within minutes with a sizable profit. However, volatile markets are also risky for people without adequate knowledge about the market.

How to identify ranging markets

Identifying a ranging market is relatively easy. All you need to do is to look at a chart and see whether the asset is making substantial movements. The best way to do this is to move from a longer-dated chart to a relatively smaller one. That’s because a stock might show no volatility on the daily chart but reveal strong movements on the hourly or 30-minute chart.

»To do this, you may need our guide on multi time frames analysis«

Use volatility indicators

The other approach is to use volatility indicators like Bollinger Bands and the Average True Range (ATR). The width of the Bollinger Bands will be significantly narrow during a ranging market. On the other hand, the Average True Range (ATR) will tend to decline substantially during a ranging market.

How to trade range markets

As mentioned, ranging markets are relatively boring for day traders since they have minimal market actions. Still, it is possible to make money during these periods.

Look for other assets

First, you should look at alternative markets when you realize that your preferred market is ranging. For example, if you are a forex trader, you can look at markets like stocks and commodities to see whether they are ranging.

Doing this will likely show you markets that have more market activities. Fortunately, many brokers and trading platforms like Real Trading offer multiple assets.

Breakouts

Second, one of the most popular strategies to traders use in range-bound markets is to wait for breakouts. This is a popular approach since ranging markets tend to be followed by a major bullish or bearish move. Therefore, such a move then becomes very profitable if you can capture it early.

There are some strategies to day trade such breakouts. The most common is to use pending orders. For example, assume that a stock is ranging between $10 and $12. In this case, you could place a buy-stop trade at $11 and add a take-profit at $15. At the same time, you could place a sell-stop at $9 and a take-profit at $7.

In this case, you will benefit regardless of the direction.

Range trading vs trend trading

As mentioned above, a stock can be said to be in a range, volatile, or in a trend environment. In most cases, trading a trending asset is substantially better than trading one that is ranging. With a trending asset, you can easily buy low and sell high or sell high and exit low. With a ranging market, it is relatively difficult to make money because assets have minimal movements.

Another disadvantage of a ranging market is that waiting for a breakout can take many days, weeks, or even months. As shown above, the price of Bitcoin remained in a tight range for more than two months.

Summary: Is range trading worth it?

A range-bound market is one that shows no meaningful moves in a certain period. Its opposite is volatility or trending. In this article, we have looked at how these markets work and some of the top strategies to trade them.

External Useful Resources

- Range Trading: A Simple Forex Strategy Explained – Valutraders