A stock market bubble refers to a situation in which equities are extremely overvalued in relation to their intrinsic value. This situation mostly happens due to irrational exuberance among investors and the thinking that stocks will always keep rising. If you think about it, we’ve seen some very significant ones in recent years.

In this article, we will look at what a bubble is, what causes it, and how you can take advantage of it as a day trader.

Table of Contents

What is a stock market bubble?

The concept of a stock market bubble is based on the efficient stock market theory. This is a simple concept that talks about how companies shares are valued. The theory states that a company’s share price reflects all the available information. Therefore, a bubble happens when a stock’s price deviates from the intrinsic value of the company.

Bubbles don’t exist in stocks only. Other assets like commodities and cryptocurrencies have experienced bubbles in the past.

A good example is what happened in 1970s, when the Hunt brothers artificially inflated the silver market. The bubble ultimately burst, pushing the metal’s price from more than $50 to less than $20.

»More info about silver trading«

Most recently, we have seen the remarkable bubble of cryptocurrencies. At their peak, the total coins tracked by CoinMarketCap were valued at more than $2 trillion.

Stages of a stock market bubble

Not all bubbles are the same. For example, the dot com bubble was significantly different from the housing market bubble of 2008/9. Yet most of these bubbles show a close resemblance in how they form. The five most common stages of a bubble are:

- Displacement – This is a stage where investors start falling in love with a new thing or event. Some of those things might be a new technology or sector. Examples of these are cloud computing, shale, and housing.

- Boom – After noticing the next big thing, investors rush to take advantage of the sector. They start buying stocks in the sector while the media starts pushing it.

- Euphoria – This is where everyone starts talking about the sector and ordinary people start buying the assets. These actions push the stock prices substantially higher.

- Exiting – At this stage, people who got in early have made substantial returns. As a result, the price starts experiencing some volatility. As the price drops, some people keep buying the dips hoping that the price will recover.

- Panic – The final stage of a stock market bubble is panic. This is where retail investors start rushing for their exit, which pushes the price significantly lower.

Examples of past bubbles

The financial market has seen many bubbles in the past. Let us look at some of them.

- Dot com bubble – The dot com bubble happened in late 1990s as investors rushed to invest in technology companies. At the time, they invested in some worthless companies that had a dot com suffix. This led to a major crash in 2000, as most of these shares declined sharply. During the bubble, Masayoshi Son became the world’s richest man. When the bubble crashed, he lost more than $50 billion.

- Housing bubble – The housing bubble happened after the dot com bubble. At the time, the housing sector became the most attractive industries for investors. Banks too provided subprime loans to anyone who asked for them. Ultimately, the housing bubble crashed in 2008.

- Individual stock bubbles – This is where a bubble affects a single or several stocks. A good example of this is companies like Blue Apron and GoPro, which saw significant gains when they went public. The shares then crashed a few years later.

- Cryptocurrency bubble – There were two cryptocurrency bubbles in the past few years. The first one burst in 2017 while the second one burst in 2021.

- Silver bubble – The silver bubble was created by the Hunt brothers who had inherited a fortune. It burst in 1980.

How to identify a stock market bubble

It is relatively easy to identify a stock market bubble. As mentioned above, the bubble forms when a company’s share price is divorced from reality. For example, if a company making an annual revenue of $100 million has a valuation of more than $30 billion, it could be said that the firm is in a bubble. This is simply because the firm’s fundamentals don’t match with the pricey valuation.

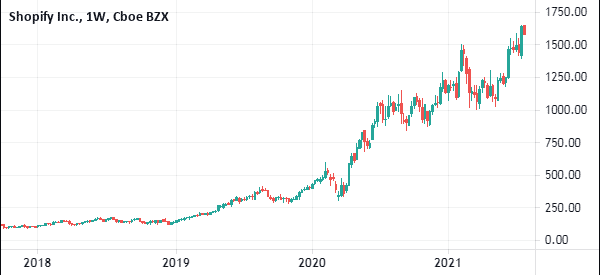

Still, this is not to say that highly-priced stocks will ultimately burst. In fact, recently, we have seen many shares have an unreasonable valuation for years. A good example is Shopify, which has revenue of less than $5 billion but one that is valued at more than $100 billion. This valuation can be justified by a company’s growth rate.

For the total stock market bubble, one way to look at it is to look at the performance of the bond market. In the past, a yield curve inversion tends to come before a stock market crash.

The simplest way to identify a bubble is to listen to talks by ordinary people. When people everywhere like taxi drivers and local retail attendants are talking about an asset, it is a sign that there is indeed a bubble.

»How to Know When a Market Correction is Approaching«

What causes a stock market bubble to burst

A stock market bubble bursts when investors realize the situation in the market and they start exiting. As they dump shares, a panic emerges as the rest of the financial market start to sell them as well. This is the primary cause of the burst.

However, at times, there could be other triggers. A popular trigger is the Federal Reserve. Since bubbles form in a low-interest-rate environment, it is possible for them to burst when the Fed hints that it will start to hike rates.

Another cause is when struggles emerge in a systemic company. For example, the housing stock market bubble happened when some banks started reporting high loan defaults. As a result, investors started selling banking shares, leading to a panic. The situation worsened when Lehman Brothers and Bear Sterns collapsed.

Summary: can you trade stock bubbles?

Stock market bubbles are generally bad for investors since they usually lead to significant losses. However, they can also be positive since they lead to significant discounts in the market.

For example, people who bought shares during the dot com bubble have received high profits over the years. At the same time, bubbles are excellent for day traders, who make money from the volatility that happens when they form.

External Useful Resources

- Preparing For The Next Stock Bubble: What Investors Need To Know – Forbes

- The myths behind the current stock market bubble – Financial Times