In June 12, 2018, the United States and North Korean leaders held their first meeting in decades. The meeting was set to address the issue of nuclear issues in the Korean peninsula.

The meeting coma after the US president and the North Korean supreme leader exchanged harsh words before. Their statements led the world to a near nuclear war, especially after North Korea delivered quality nuclear weapons that could reach the US.

The language changed and the North Korean leader moved to ease the tensions. He asked the US president for a meeting to discuss what he called the complete denuclearization of the Korean peninsula.

This meeting was very important not only to North Korea but to the world. If it works, it will be a good day for the world peace. If it fails, it will be a difficult day for the two countries and the world.

There have been other risks in the market. For example, in February 2022, Russia sent shivers around the world when it invaded Ukraine. Another example of risk was the Covid-19 pandemic.

Traders followed closely the ongoing happenings. As such, the need for safe haven assets will be important.

Related » Trading Commodities: 10 Key point to focus on

Table of Contents

What is a safe haven?

A safe haven is a financial asset that investors and traders rush to in times of rising risks. The haven can be a stock, a currency, a commodity, an ETF, or a bond.

Below, we’re going to briefly look at a few of the most popular safe havens among traders.

Characteristics of a Safe Haven Asset

- Limited supply: Scarcity of the asset is what maintains its high value.

- High liquidity: This means that one’s investment into such an asset should be easy to convert into cash.

- Sustained demand: Safe haven assets are irreplaceable with other forms of investments. To maintain this status, the asset’s demand should be consistently high.

- Permanence: A safe haven asset should not be subject to loss of quality in ways such as decay. At the same time, it should be of high performance in the long-term in order to maintain its high demand.

Assets that are referred to as safe havens

Gold

Gold is a metal that has been in use for centuries. All historical books mention the importance of gold. Today, gold has no major industrial use. Its only use is in the investment world where governments hold it for investment purposes.

Traders use gold as a safe haven because they believe that if there is an Armageddon, its value will climb. In fact, the price of gold tends to move up as the dollar and the markets fall.

For instance, in August 2020, prices of the yellow metal reached an all-time high of about $2074.The upward momentum was fueled by the rising coronavirus cases. Investors were shifting their resources to gold to insure their wealth against the economic crisis.

Related » Gold Trading, easy tips to make it profitable

Silver

In addition to being an industrial metal, silver is a precious metal. Just like gold, investors consider it as a safe haven, store of value, and a reliable hedge against inflation. While it is possible to purchase silver in the form of coins or bars, the more reliable option is via ETFs or a futures contract.

In 2020, silver prices rose by about 50%.

US Dollar

As the world’s reserve currency, investors often store their wealth in the dollar during economic or geopolitical crisis.

For instance, as soon as the WHO announced COVID-19 as a global pandemic in March 2020, the greenback hit a 3-year high of around $103.

Treasuries

Investors love certainty. They always want to know that their money is safe. As such, they try to lend the cash to the government because they are always certain that the government will pay the money back.

However, the yields on these bills tend to be low because of the certainty. However, this certainty often reduces when there are major geopolitical issues. This leads the yields to rise.

Related » The Yield Curve Explained

Japanese Yen

Japan is located near the Korean peninsula. As such, it is often ironic that a country that is very close to the Korean peninsula would be considered a safe haven. The reality is that if there is a crisis in the peninsula, there would be demand for the Japanese yen.

This is because of the vast holdings Japan owns overseas. For example, Japan is the second largest holder of US debt after China. This makes the yen a better currency to hold over the dollar because the yen would see more demand.

Related » Tokyo Stock Exchange (TSE)

Swiss Franc

Switzerland is one of the most unique country in the world. While it is in Europe, the country avoided joining the EU. Earlier on, it took a neutral stand on the two world wars.

The country does not have a lot of natural resources but what makes it unique is its financial system. A good number of the world’s wealthiest people are known to stash their wealth in the country because of its lax regulations.

Cash

Finally, cash is a good safe haven. This is because in dark days, other assets might not be readily available. For example, in case there is a major issue, it would be difficult to convert other assets into cash.

As such, cash is always king and as a trader, you need to have a good part of your portfolio in cash.

Crude oil

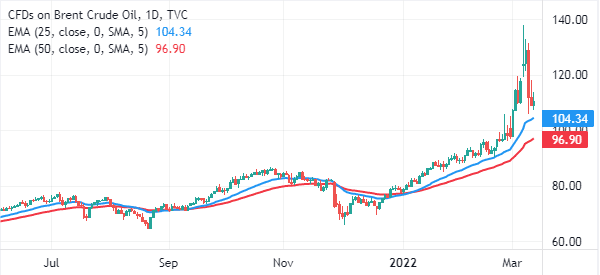

At times, crude oil can be a safe haven depending on the risk. A good example of this is what happened in early 2022 when Russia invaded Ukraine. Because of the importance of Russia in the energy market, the price of crude oil jumped to a decade high as you can see below.

However, oil is not always a safe haven. For example, its price dropped to the negative level in early 2020 when the Covid-19 pandemic started.

» Related: How to trade crude oil

How to trade safe havens

As shown above, safe havens are just ordinary assets. Therefore, trading them is not different from what other assets are traded.

There are three key parts of this analysis. First, you should focus on fundamental analysis, where you study the underlying risk well. You can look at economic data and read the latest news to find this information.

Second, you should focus on technical analysis, which is the use of indicators like moving averages and Stochastic oscillators to find trading signals. Finally, you should do price action analysis that involves looking at chart patterns.

Still, you need to ensure that you employ some risk management strategies even when trading safe havens. For example, you should use adequate leverage, avoid leaving your trades overnight, and use well-thought trading volume. Doing this will help to protect your account in times of high risks.

The downside

While safe haven assets are an apt inclusion in your investment portfolio, they are not always safe. The volatility of the market during certain scenarios makes it impossible to bet on safe haven assets in totality.

For instance, as the coronavirus pandemic took shape in March 2020, gold prices dropped to around $1450. Investors who had shifted their resources to the precious metal during this phase incurred hefty losses.

External useful Resources

- How Safe Are Your Safe-Haven Assets? – Forbes